Inflation Climbs to 3.8% as Treasurer Defends Government Record Against Coalition’s ‘Jimflation’ Attack

This piece is freely available to read. Become a paid subscriber today and help keep Mencari News financially afloat so that we can continue to pay our writers for their insight and expertise.

Today’s Article is brought to you by Empower your podcasting vision with a suite of creative solutions at your fingertips.

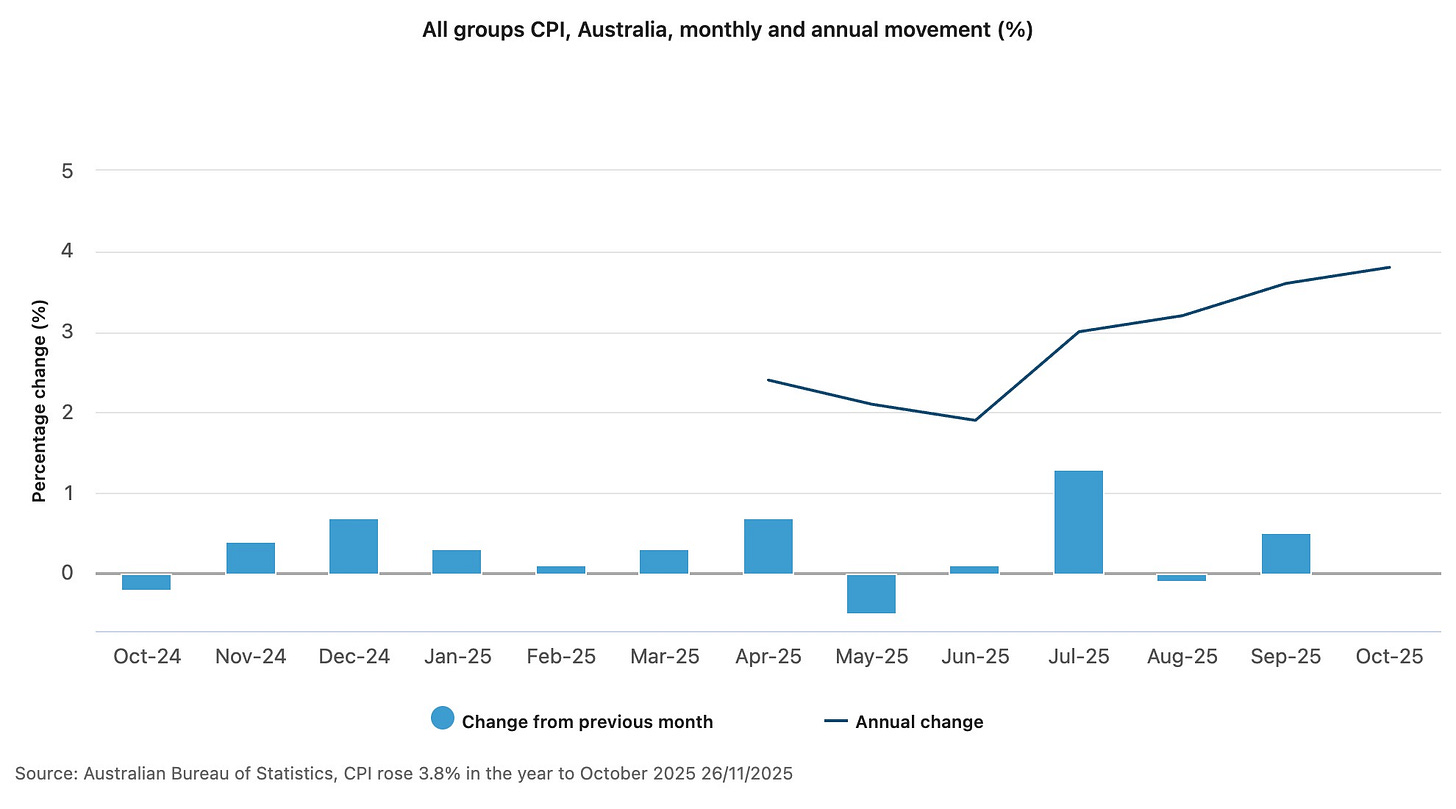

Australian inflation rose to 3.8% annually in October, higher than economists expected, prompting a fierce parliamentary clash between the Albanese government and Coalition critics who labelled the result “Jimflation” and warned mortgage holders can “kiss goodbye” to any rate relief before Christmas.

The Australian Bureau of Statistics data released Wednesday showed prices were flat in October — a monthly reading of 0.0% — but the through-the-year figure ticked up to 3.8%, driven partly by the withdrawal of state energy rebates and volatile travel costs. The result exceeded market expectations and remains well above the Reserve Bank of Australia’s 2-3% target band.

Treasurer Jim Chalmers (Labor, Rankin, QLD) addressed the figures in a press conference shortly after the release, acknowledging the annual number was “higher than we’d like” while emphasising it remained substantially lower than the 6% inflation the government inherited upon taking office.

“Annual through-the-year inflation is higher than we’d like, but it is much, much lower than we inherited from our predecessors,” Chalmers said. “What we saw was inflation of 0.0 in October, but we do acknowledge that the through-the-year number was higher than we’d like it to be, but driven partly by temporary factors like the removal of state energy rebates.”

Truth matters. Quality journalism costs.

Your subscription to Mencari directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. There is no corporate influence involved. No compromises. Just honest journalism when we need it most.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

The Treasurer pointed to falls in electricity prices (down 10% in October), moderating housing costs, and declining fuel prices as positive indicators. He attributed part of the annual increase to the timing of Commonwealth and state energy rebates, which he described as “temporary factors.”

Within hours, the inflation data became the centrepiece of a bruising parliamentary Question Time. Opposition Leader Sussan Ley (Liberal, Farrer, NSW) led the attack, telling the House that Australians “were misled” by government assurances that inflation was under control.

“Today’s numbers show that Australians were misled. Prime Minister, why do Australians have to pay the price for Labor’s economic failure?” Ley asked during Question Time.

Deputy Opposition Leader Ted O’Brien (Liberal, Fadden, QLD), delivering his first major address as Shadow Treasurer at the National Press Club, coined the term “Jimflation” to describe what he characterised as a direct consequence of government spending decisions.

“With just 29 days until Christmas, this is the worst possible news for struggling mortgage holders who can now kiss goodbye to any rate cut, any rate cut at all,” O’Brien told the Press Club. “And that dream of home ownership just keeps getting further away.”

O’Brien used his speech to frame the inflation challenge in personal terms, telling the story of “Jess” — a 38-year-old married mother of two living in a rented townhouse — as representative of millions of Australians struggling with the cost of living.

“In recent years, their rent has gone up by 20%, electricity bills 40%, and their weekly grocery shop is now nearly $300,” O’Brien said. “This is the Australian story of 2025.”

Prime Minister Anthony Albanese (Labor, Grayndler, NSW) defended his government’s economic management during Question Time, noting that three interest rate cuts had been delivered in 2025 and pointing to eight consecutive quarters of real wage growth.

“When it comes to inflation, we also know that the work is never done, which is why my government is very focused on cost of living measures and putting that downward pressure on inflation,” Albanese said.

The Prime Minister turned the attack back on the Coalition, reminding the House that inflation stood at 6% when Labor took office and accusing the Opposition of proposing policies that would increase taxes and expand deficits.

Chalmers used his response during Question Time to contrast the government’s fiscal record — including two surplus budgets and $100 billion in savings — with the Coalition’s nine consecutive deficit budgets. He criticised the Opposition’s economic messaging as recycled rhetoric.

“The speech that the member for Fairfax gave sounded exactly like the speeches the member for Hulme used to give,” Chalmers said, referencing former Shadow Treasurer Angus Taylor.

The electricity component of inflation showed a stark 37% year-on-year increase in the annual figures, though the monthly data showed a 10% fall in October attributed to the impact of energy rebates. When pressed on whether federal household support for energy bills would continue, Chalmers indicated a decision would be made “closer to the release of the mid-year update” expected in mid-December.

The Treasurer confirmed the mid-year economic forecast update would include some savings measures but would not constitute a “mini-budget,” with the main fiscal announcements reserved for the May 2026 budget. He revealed that departments have been asked to identify areas where lower-priority spending could be redirected to higher priorities.

On questions about public service staffing, Chalmers clarified the government was not proposing that every department cut staff or programs by 5%, but was instead seeking input on reprioritisation opportunities — a process he described as consistent with previous budget preparations.

The inflation data arrives as the RBA weighs monetary policy settings, with analysts now suggesting another rate cut before year’s end is increasingly unlikely. The central bank’s inflation target of 2-3% remains out of reach, with both headline and underlying measures elevated.

Market economists had anticipated a slightly lower reading, and the result is expected to temper expectations for near-term monetary policy easing. The combination of housing cost pressures (up nearly 6%) and electricity price volatility continues to challenge the path back to target inflation.

Sustaining Mencari Requires Your Support

Independent journalism costs money. Help us continue delivering in-depth investigations and unfiltered commentary on the world's real stories. Your financial contribution enables thorough investigative work and thoughtful analysis, all supported by a dedicated community committed to accuracy and transparency.

Subscribe today to unlock our full archive of investigative reporting and fearless analysis. Subscribing to independent media outlets represents more than just information consumption—it embodies a commitment to factual reporting.

As well as knowing you’re keeping Mencari (Australia) alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting The Evening Post (Australia)

Catch up on some of Mencari’s recent stories:

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!