ASIC Chief Warns Australia Must ‘Innovate or Stagnate’ as IPO Market Collapses 80%

This piece is freely available to read. Become a paid subscriber today and help keep Mencari News financially afloat so that we can continue to pay our writers for their insight and expertise.

Today’s Article is brought to you by Empower your podcasting vision with a suite of creative solutions at your fingertips.

Australia’s financial markets regulator issued a stark warning Tuesday that the nation must embrace rapid innovation or risk being left behind as initial public offerings plummet 80% and private capital fundamentally reshapes the country’s $3.3 trillion equity markets.

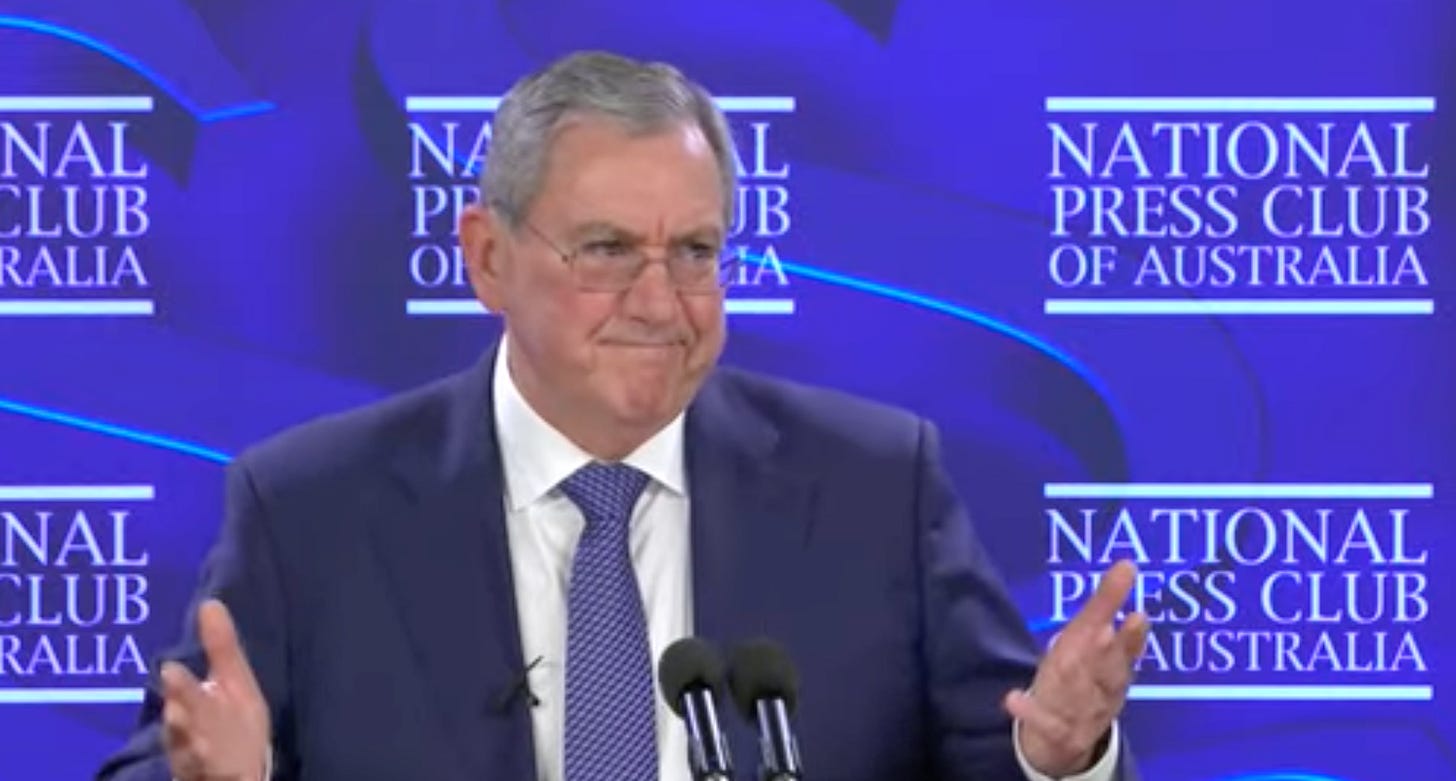

ASIC Chair Joe Longo told the National Press Club that equity raised through IPOs in Australia has crashed from $22.9 billion in 2014 to just $4.2 billion in 2024, signaling a dramatic structural shift as companies stay private longer and bypass traditional public listings.

“Australia must innovate or stagnate, seize the opportunity or be left behind,” Longo said in his address. “Right now, Australia faces a choice about the future of our markets. The world is changing and our markets need to change with it.”

The outgoing ASIC chair, who departs the commission in May after nearly four years leading the corporate regulator, painted a picture of Australian financial markets at a crossroads as private capital booms and public markets concentrate in the hands of fewer, larger companies.

Truth matters. Quality journalism costs.

Your subscription to Mencari directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. There is no corporate influence involved. No compromises. Just honest journalism when we need it most.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

Private Capital Surge Transforms Investment Landscape

Longo revealed Australia’s private credit sector has exploded 500% over the past decade to more than $2 billion, though the figure remains small compared to the country’s $3.3 trillion listed equity markets.

The explosive growth stems largely from Australia’s superannuation system, which has ballooned to more than $4.3 trillion and now outpaces growth in both gross domestic product and public markets.

“In the past decade, our superannuation system has grown to more than $4.3 trillion, outpacing growth in both GDP and our public markets, and has become a structural driving force in developing private markets,” Longo said.

Superannuation trustees now play a key role enabling retail investment in private markets, with most Australians accessing those markets primarily through their super funds.

“For most Australians, the main road into those markets currently runs through their super fund,” Longo said.

The ASIC chair emphasized private credit’s emergence as an important funding source for sectors underserved by traditional banking, providing more diversification and choice for borrowers and investors.

“The growth of private markets has been fundamentally good for the Australian economy,” Longo said. “Private credit in particular has emerged as an important source of funding for sectors that are currently underserved by the traditional banking sector.”

Public Markets Face Concentration Crisis

While private markets surge, Australia’s public markets face troubling concentration as the ASX market capitalization nearly doubled over the past decade even as the actual number of listed companies declined.

The top 20 companies on the ASX now account for more than half of market capitalization, making Australia one of the most concentrated markets in the world, Longo said.

The combination of fewer listed companies and growing market dominance by large firms has fundamentally altered the investment landscape for retail and institutional investors seeking diversification.

“In the past decade, the market capitalisation of the ASX has nearly doubled, yet the actual number of listed companies has declined,” Longo said. “The top 20 companies on the ASX account for more than half of market capitalisation, making Australia one of the most concentrated markets in the world.”

Companies Stay Private Longer

The dramatic shift reflects companies’ ability to access growth capital without going public, enabled by the rapid expansion of private markets and new funding mechanisms.

“What we’ve seen is that the rapid growth of private capital in the economy is actually enabling companies to stay private for longer,” Longo said. “In other words, companies don’t need to go public to grow anymore.”

New platforms like FCX entering the Australian market are building bridges between public and private markets, accelerating what Longo described as a fundamental convergence.

“In the past, we’ve tended to talk about public and private markets as if they were totally separate,” Longo said. “But what our work is showing is a convergence, a shift from public or private to a single concept, the concept of the market, a shift that will only accelerate with new technology.”

Technology Revolution Coming

Longo warned that technology developments over the next decade will make current investing landscapes appear as antiquated as 1980s trading floors, with distributed ledger technology and asset tokenization poised to fundamentally transform capital markets.

“Technology developments over the next decade and beyond will make our current investing landscape appear as antiquated as the trading flaws of the 1980s,” Longo said. “Distributed ledger technology that facilitates asset tokenisation could fundamentally transform our capital markets in the same way as the introduction of chess once did.”

The regulator emphasized Australia must position itself at the forefront of these technological changes rather than passively accepting transformations driven by global forces.

“We shouldn’t be passive recipients of these changes,” Longo said. “We should be ambitious and seize opportunities, and we should put the foundations in place today to ensure we will have the future that we want.”

Personal Journey Shapes Worldview

Longo opened his address by acknowledging his immigrant background, saying his parents came to Australia from Italy after World War II and met in Sydney before running out of money in Perth while trying to return to Italy.

“I spent much of my childhood in the back of my parents’ greengrocer shop,” Longo said. “Later, my mother, who was missing Italy terribly, wanted to move back. But my father was adamant that the children’s future was in Australia. Why? Because Australia was and is the land of opportunity.”

He framed his warning about innovation and stagnation within that immigrant success story, saying Australia has long delivered on its promise of opportunity and a better life for the next generation.

“That’s the Australian promise,” Longo said. “Opportunity and a better life for the next generation. And it’s a promise for a long time Australia has delivered on. But I’m here today with a warning.”

Like almost half of all Australians, Longo is the child of immigrants, a background he said shapes his understanding of Australia’s economic promise and potential.

Critical Role for Public Markets

Despite celebrating private capital growth, Longo emphasized public markets remain critical to Australia’s economy and ASIC is committed to making them as attractive and accessible as possible.

“Of course, the important role for public markets remains and ASIC is committed to doing what we can to make them as attractive and accessible as possible,” Longo said. “However, what we’ve seen is that the rapid growth of private capital in the economy is actually enabling companies to stay private for longer.”

The regulatory challenge involves balancing support for private market innovation while maintaining robust public market infrastructure that has historically underpinned Australian corporate capital formation.

Regulatory Modernization Needed

Longo called for regulatory frameworks that evolve alongside market transformations, ensuring Australia can capitalize on opportunities presented by converging public and private markets and emerging technologies.

The ASIC chair, who commenced his role on June 1, 2021, has held senior leadership positions for four decades across corporate law, financial services, regulation and law enforcement.

His National Press Club address marks one of his final major public statements before departing the commission in May, offering a comprehensive assessment of market trends and challenges facing Australia’s financial system.

Commissioner Composition Recommendations

Asked about the future composition of ASIC’s leadership, Longo suggested the commission needs scientific and data expertise at senior levels to navigate technological transformation.

“I think I would encourage, by the way, I encourage this with boards as well, that there needs to be some respect for science and scientific expertise at the top of the house who understand data, technology, who have some sympathy for the subject,” Longo said. “That’s just a personal view.”

He noted the legislation governing ASIC commissioner appointments doesn’t mention science and data expertise, an omission he believes should be addressed given the technological revolution reshaping financial markets.

Seizing the Moment

Longo closed by emphasizing the urgency of Australia’s choice about market evolution, framing the decision as fundamental to maintaining the country’s economic competitiveness and promise of opportunity.

“Before I talk about what’s ahead, though, it’s worth taking stock of where we are now,” Longo said. “Over the past decade, there have been significant structural changes in our markets.”

The ASIC chair’s warning about innovation versus stagnation resonates as Australia navigates global financial market transformation accelerated by technology, changing capital allocation patterns and the rise of alternative funding mechanisms that challenge traditional public market dominance.

His address underscores the complex regulatory challenges facing Australian authorities as they balance fostering innovation in private markets with maintaining public market vitality essential to broad-based retail investment and economic transparency.

The collapse in IPO activity from $22.9 billion to $4.2 billion over a decade represents one of the most dramatic shifts in Australian capital markets history, raising questions about whether the trend reflects temporary market conditions or permanent structural change in how companies access growth capital.

Longo’s departure in May leaves incoming ASIC leadership to navigate these challenges as markets continue evolving rapidly amid technological disruption and shifting investor preferences between public and private investment opportunities.

Sustaining Mencari Requires Your Support

Independent journalism costs money. Help us continue delivering in-depth investigations and unfiltered commentary on the world's real stories. Your financial contribution enables thorough investigative work and thoughtful analysis, all supported by a dedicated community committed to accuracy and transparency.

Subscribe today to unlock our full archive of investigative reporting and fearless analysis. Subscribing to independent media outlets represents more than just information consumption—it embodies a commitment to factual reporting.

As well as knowing you’re keeping Mencari (Australia) alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting The Evening Post (Australia)

Catch up on some of Mencari’s recent stories:

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!