📰 Westpac SafeBlock: Stopping scammers in their tracks

Westpac will launch SafeBlock, a new tool that lets consumers instantly block their account should they believe they are being scammed, so halting scammers in their tracks.

This creative technology offers peace of mind in the battle against frauds and fraud and adds an additional degree of protection.

New transactions, including digital and card payments, transfers, and ATM withdrawals, will be blocked by activating SafeBlock in the Westpac app or online banking, so stopping unwelcome parties from acting and maybe resulting in financial loss. Once account security has been confirmed, customers may disable SafeBlock.

Westpac Group Executive, Customer & Corporate Services Carolyn McCann said the new technology will make it easier for customers to protect their funds in a moment of distress and make it harder for scammers to target people.

"We are protecting our customers from the ongoing threat of scams. Westpac SafeBlock is a game-changer, offering customers a simple yet powerful tool to protect their accounts if they think they’ve been scammed," Ms McCann said.

“From experience, we know that scammers strike when we are at our busiest, often catching out unsuspecting customers. With SafeBlock, if a customer suspects they have been scammed, they will be able to immediately block their accounts in the app, preventing any further damage.”

“This is a break-glass emergency option for customers so they can stop a scam in the moment when acting fast is absolutely vital.”

“We’re continuing to introduce new tools to help bring down scam losses but we need other organisations across Australia to step up and stop scams at the source, so we can shut these criminals down.”

The new technology is Westpac’s latest innovation to bolster its scam fighting capabilities and provide convenient banking options to customers. It will be available for customers in the coming months via the Westpac app and online banking. Over the past two years Westpac has invested over $100 million in scam prevention saving customers over $400 million from being lost to scammers. Key initiatives have included:

Westpac SafeCall – provides customers with calls via the app that are Westpac branded, verified by Optus and show a reason for the call.

Westpac SaferPay – presents customers with a series of questions in instances where a payment is considered a high risk of being a scam.

Westpac Verify – alerts customers when there is a potential account name mismatch when they’re adding a new payee using a BSB and account number. Verify was recently introduced for St.George, Bank of Melbourne, and BankSA customers.

Dynamic CVC – changes the three-digit code on the back of the digital card every 24-hours. This feature is also available for St.George, Bank of Melbourne, and BankSA customers.

Cryptocurrency blocks – for payments to certain digital currency exchanges.

Merchant blocks – for payments to businesses deemed high-risk of being a scam (e.g. offering fake or misleading products and services).

Call spoofing measures – added 94,000 Westpac numbers to the ‘Do Not Originate’ list preventing scammers from impersonating the bank’s phone numbers.

Inbound payment detection – monitoring on payments coming into the bank to check for potential scam indicators, with funds held where a scam is detected.

Sophisticated detection technology – advanced behavioural tool helping combat remote access scams.

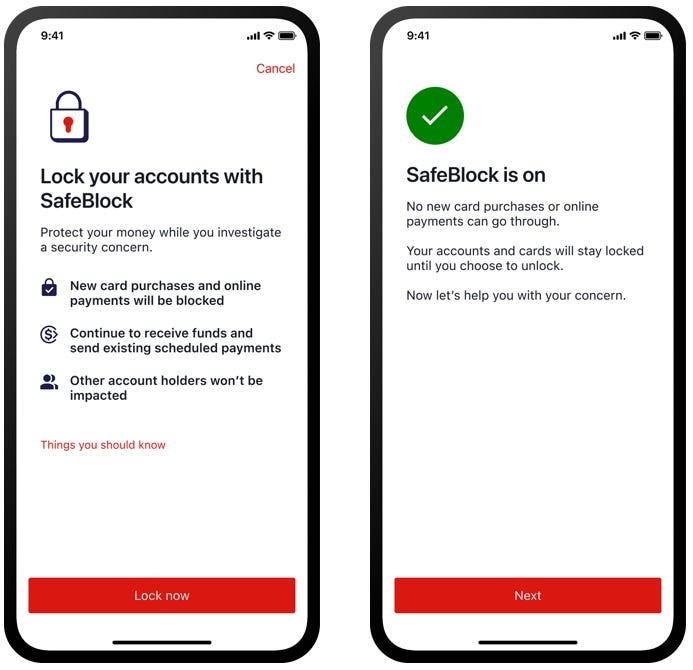

How Westpac SafeBlock works:

Customers can access Westpac SafeBlock through the app or online banking, locking their accounts in a few simple steps.

Once SafeBlock is activated, no new digital payments, transfers or card purchases can go through. Pre-scheduled transfers and subscriptions that’ve been established with a BSB and account number will continue as normal to minimise disruption.

Once a SafeBlock has been placed, customers will be able to report any suspicious transactions for our team to investigate. We will contact customers where there is potential fraud or scam activity.

Once the account has been secured, customers can simply verify their identity to unblock their accounts.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

More on Mencari

5 - Minute recap - for nighly bite-sized news around Australia and the world.

Podwires Daily - for providing news about audio trends and podcasts.

There’s a Glitch - updated tech news and scam and fraud trends

The Expert Interview - features expert interviews on current political and social issues in Australia and worldwide.

Viewpoint 360 - An analysis view based on evidence, produced in collaboration with 360Info

Mencari Banking - Get the latest banking news and financials across Australia and New Zealand

The Mencari readers receive journalism free of financial and political influence.

We set our own news agenda, which is always based on facts rather than billionaire ownership or political pressure.

Despite the financial challenges that our industry faces, we have decided to keep our reporting open to the public because we believe that everyone has the right to know the truth about the events that shape their world.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support Mencari.

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!