📰 NAB Combats Cyber Fraud: Hundreds of Fake Banking Websites Shut Down

In an escalating battle against digital deception, National Australia Bank (NAB) has taken aggressive action against cybercriminals by removing nearly 600 fraudulent websites designed to steal personal information from unsuspecting Australians. These sophisticated imitation sites, closely resembling NAB's official banking platforms, pose a significant threat in Australia's digital landscape, where scammers deploy increasingly convincing tactics to exploit consumers.

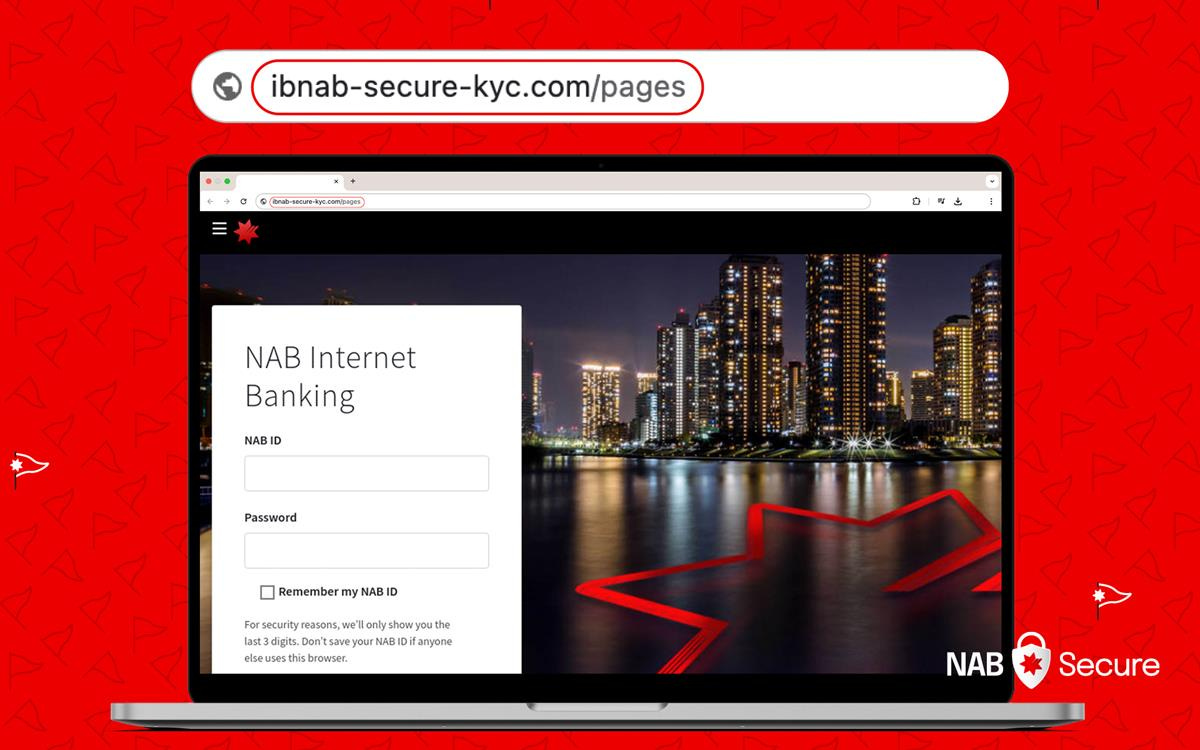

Scammers create fake NAB websites that closely resemble the real ones to deceive individuals into disclosing their banking details and personal information. These fake sites often appear in messages claiming there's an urgent problem with your account or promising unrealistic investment opportunities. NAB has been swiftly shutting down these sites and advising customers to vigilantly check website addresses, urging caution with messages containing links that appear overly promising.

Key Points:

NAB has identified and removed almost 600 fraudulent websites impersonating the bank in 2024 alone

Criminals typically use spoofed URLs, urgency tactics, and fake endorsements to lure victims

On average, NAB requests takedowns of two malicious websites every day

The bank has taken immediate protective measures by including identified fake sites in Google and Microsoft block lists.

Why It Matters

This widespread digital fraud jeopardizes the financial security of millions of Australians who are increasingly dependent on online banking services. The complexity of these scams renders them challenging for average consumers to identify, possibly resulting in substantial financial losses, identity theft, and enduring credit harm. NAB's proactive stance highlights the growing recognition that financial institutions must take a leading role in customer protection beyond traditional banking services, as digital security becomes a fundamental aspect of consumer trust.

The Bigger Picture

The proliferation of these convincing fake banking sites is indicative of a broader challenge confronting Australia's digital economy. With the shift of financial transactions to online platforms, the conflict between legitimate institutions and cybercriminals has escalated, necessitating unparalleled cooperation among banks, technology firms, telecommunications providers, and regulators. Addressing this evolving threat landscape requires advancements in technology as well as enhanced consumer education and awareness, potentially reshaping Australians' interactions with digital financial services in the future.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

More on Mencari

5 - Minute recap - for nighly bite-sized news around Australia and the world.

Podwires Daily - for providing news about audio trends and podcasts.

There’s a Glitch - updated tech news and scam and fraud trends

The Expert Interview - features expert interviews on current political and social issues in Australia and worldwide.

Viewpoint 360 - An analysis view based on evidence, produced in collaboration with 360Info

Mencari Banking - Get the latest banking news and financials across Australia and New Zealand

The Mencari readers receive journalism free of financial and political influence.

We set our own news agenda, which is always based on facts rather than billionaire ownership or political pressure.

Despite the financial challenges that our industry faces, we have decided to keep our reporting open to the public because we believe that everyone has the right to know the truth about the events that shape their world.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support Mencari.

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!