Labor's super tax proposal misrepresented as tax on all paper profits

By Matthew Elmas in Sydney

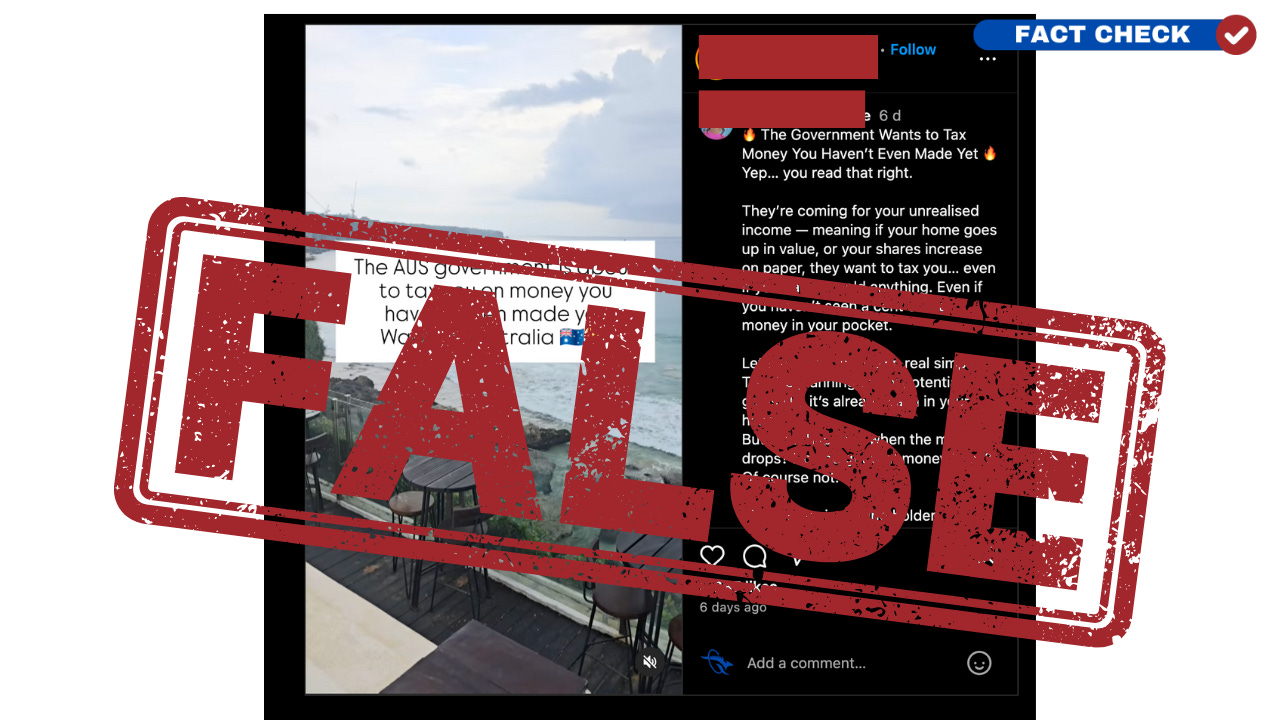

WHAT WAS CLAIMED : The Labor government is planning a new tax on all unrealised gains.

OUR VERDICT : The tax would only apply to gains in super accounts worth more than $3 million.

The government isn't planning a new tax on all unrealised gains, including homes and shares, to trap Australians in "financial slavery", despite social media claims.

The Albanese Labor government's proposed tax changes would only apply to unrealised gains in superannuation balances of more than $3 million, not all unrealised gains.

Unrealised gains are 'paper profits', increases in the value of assets such as properties or shares that haven't been sold yet.

The claim is in an Instagram video featuring a panning shot over a cliffside bar and a warning that the government plans to "tax it all".

"They're coming for your unrealised income — meaning if your home goes up in value, or your shares increase on paper, they want to tax you… even if you haven't sold anything. Even if you haven't seen a cent of that money in your pocket," the caption says.

The post continues: "Unrealised income tax is just one more way they'll trap you in financial slavery."

"You work hard. You save. You invest. And they want to control and tax it all."

The Instagram video's overlay text also says: "The Aus government is about to tax you on money you haven't even made yet".

However, this is false as the changes only apply to superannuation accounts with balances of more than $3 million.

The Albanese government introduced laws in 2023 that changed the concessional arrangements on superannuation earnings for accounts valued over $3 million.

Currently, earnings on superannuation accounts in the accumulation phase, when money is being contributed prior to retirement, are taxed at a concessional rate of up to 15 per cent.

Under the proposed changes (p3), super accounts will be subject to an additional 15 per cent tax on the percentage of earnings on their super balance exceeding $3 million.

The reforms remain before the Senate, but are expected to pass with the support of the Greens when parliament resumes from July 22.

The government has previously estimated that about 0.5 per cent of superannuation accounts - about 80,000 - will be subject to the changes.

Commentators have raised concerns that the policy could open the door to wider "wealth taxes", but in its current form, it does not apply to all unrealised gains.

A Treasury spokesperson pointed AAP FactCheck to the 2023 policy announcement.

"More than 99.5 per cent of Australians will continue to receive the same generous tax breaks that help them save more for retirement through superannuation," the release said.

"The 0.5 per cent of individuals with superannuation accounts over $3 million will receive less generous tax breaks for balances that are beyond what is necessary to fund a comfortable retirement."

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Instagram, Threads, X, BlueSky, TikTok and YouTube.

At Mencari, we think it's super important to fact-check to fight misinformation and disinformation and to keep citizens and voters informed and educated.

We invite the public to send us their feedback and requests for fact-checks at factcheck@readmencari.com.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

As well as knowing you’re keeping MENCARI alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting Mencari's

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!