📰 Housing Market Rebounds as Melbourne and Hobart Lead February Recovery

Australian property market sees promising turnaround as strategic rate cut expectations fuel renewed buyer confidence across major cities.

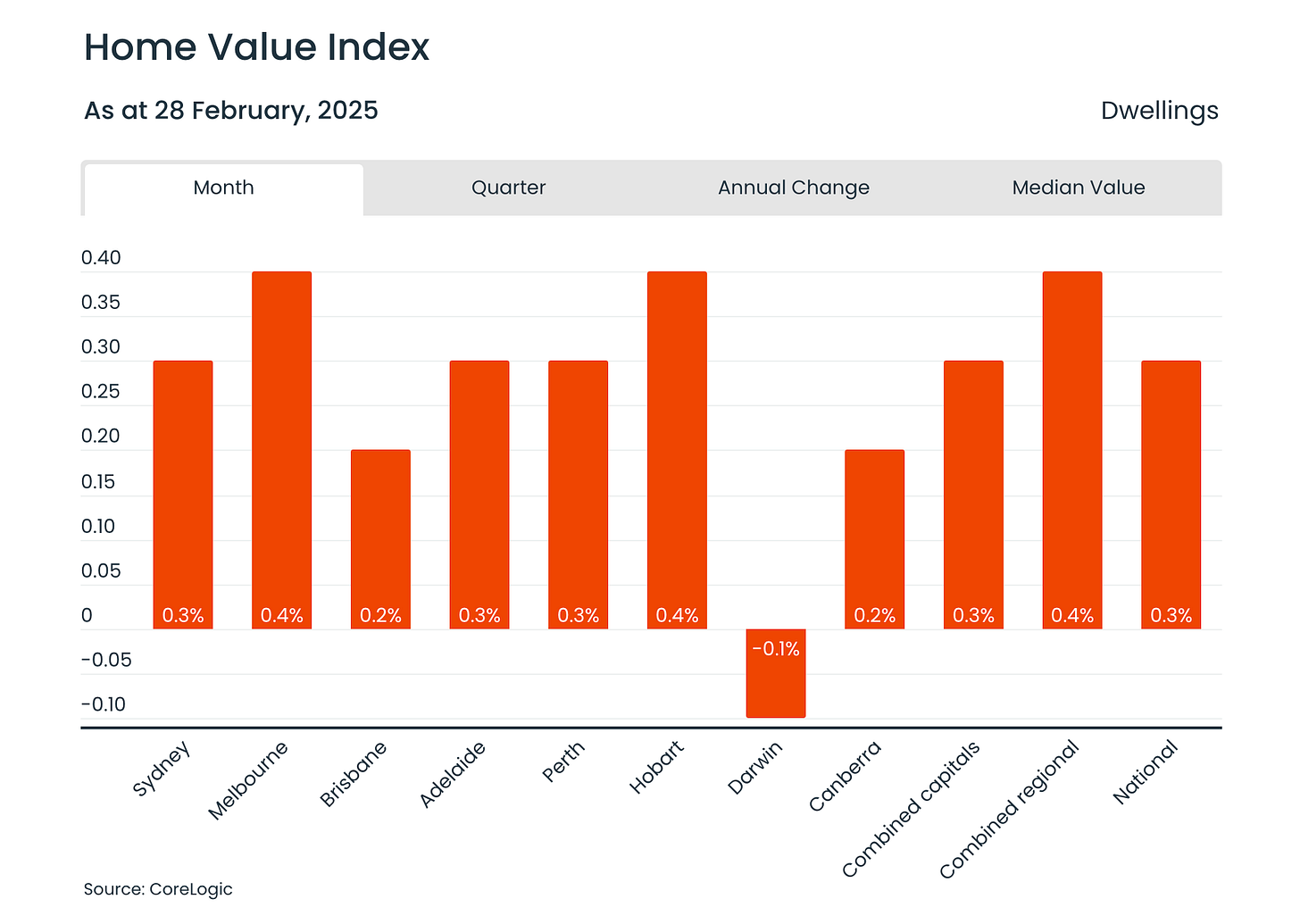

In February, the Australian housing market staged a decisive comeback, breaking a three-month downturn with a modest but significant 0.3% national rise in home values.

This reversal marks a potential inflection point in market dynamics, with Melbourne and Hobart emerging as surprising frontrunners after prolonged periods of weakness, leading the market recovery. The broad-based recovery, affecting nearly all capital cities and regional areas, appears primarily driven by improved market sentiment rather than immediate changes in borrowing capacity, suggesting a psychological shift as expectations of lower interest rates solidify among prospective buyers.

Key Insights from CoreLogic's February Housing Report:

Melbourne ends 10-month decline: After nearly a year of consecutive monthly falls, Melbourne property values rose 0.4%, signaling a potential market recalibration in Australia's second-largest city

Premium market resurgence: Higher-value properties in Sydney and Melbourne are leading the recovery, confirming historical patterns where premium segments respond earliest to anticipated rate cuts in these cities.

Regional outperformance continues: Regional areas maintained stronger growth (0.4% monthly, 1.0% quarterly) compared to capital cities, though the gap is narrowing

Supply constraints supporting prices: New listings are tracking 4.7% lower than last year and 1.5% below the previous five-year average, creating upward pressure on values due to reduced supply.

Why It Matters

This market reversal holds significant implications for Australia's economic trajectory in 2025. The shift from mid-sized capitals (Brisbane, Perth, Adelaide) to previously underperforming markets indicates a rebalancing that could address affordability disparities between cities. Meanwhile, the rental market's continued moderation (4.1% annual growth versus pre-pandemic average of 2.0%) reflects changing household formation patterns and normalizing migration, potentially easing cost-of-living pressures for tenants while supporting modest yield improvements for investors.

The Bottom Line

For financial professionals, February's housing data presents a nuanced investment landscape with strategic opportunities and persistent challenges. The emerging recovery appears sustainable but measured, with rate-cutting cycles expected to remain gradual and restrictive. Markets with significant value corrections (Hobart -11.9%, ACT -7.1%, Melbourne -6.4%) present relative value opportunities, particularly in premium segments. However, supply constraints in Perth (-28.0%), Adelaide (-33.9%), and Brisbane (-21.5%) will maintain competitive conditions in these markets. The tentative improvement in gross rental yields (3.72% nationally) provides modest income enhancement but remains historically compressed.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

More on Mencari

5 - Minute recap - for nighly bite-sized news around Australia and the world.

Podwires Daily - for providing news about audio trends and podcasts.

There’s a Glitch - updated tech news and scam and fraud trends

The Expert Interview - features expert interviews on current political and social issues in Australia and worldwide.

Viewpoint 360 - An analysis view based on evidence, produced in collaboration with 360Info

Mencari Banking - Get the latest banking news and financials across Australia and New Zealand

The Mencari readers receive journalism free of financial and political influence.

We set our own news agenda, which is always based on facts rather than billionaire ownership or political pressure.

Despite the financial challenges that our industry faces, we have decided to keep our reporting open to the public because we believe that everyone has the right to know the truth about the events that shape their world.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support Mencari.

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!