Chalmers Consulted Superannuation Architect Paul Keating Six Times Before Reform Announcement

This piece is freely available to read. Become a paid subscriber today and help keep Mencari News financially afloat so that we can continue to pay our writers for their insight and expertise.

Today’s Article is brought to you by Empower your podcasting vision with a suite of creative solutions at your fingertips.

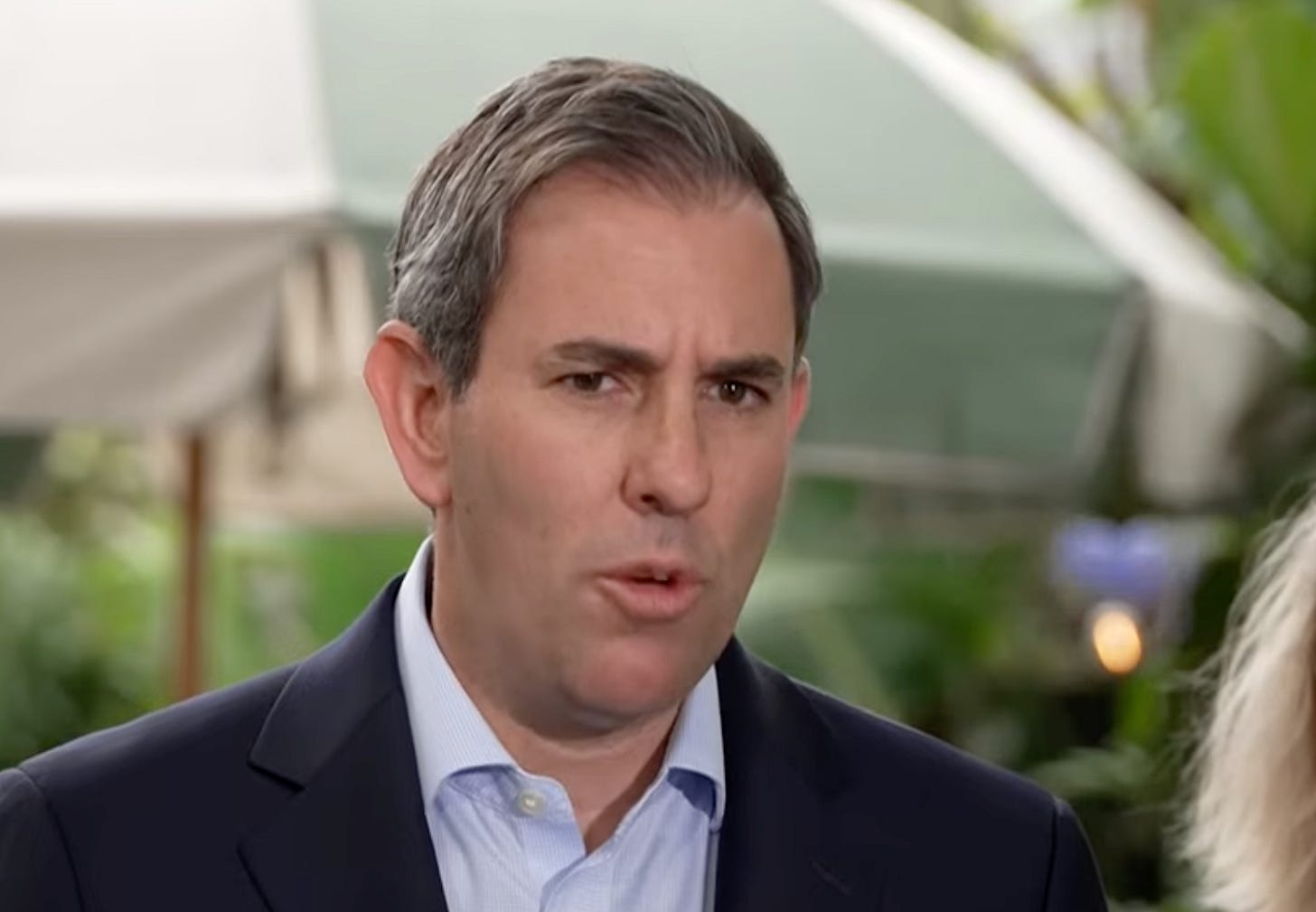

Treasurer Jim Chalmers revealed Tuesday he spoke with former Prime Minister Paul Keating half a dozen times in the final week before announcing major superannuation reforms, underscoring the current government’s reliance on the retirement system’s original architect as it navigates politically sensitive changes to tax concessions affecting millions of Australians.

The extensive consultations between Australia’s current Treasurer and the former Labor leader who created the compulsory superannuation system three decades ago highlight the political and policy significance of reforms announced Tuesday that will reshape taxation for both low-income workers and the wealthiest account holders.

“I’ve been speaking to Paul about this for some years and I think I spoke to him half a dozen times in the second half of last week,” Chalmers told reporters in Brisbane Tuesday following his announcement of changes to the Low Income Superannuation Tax Offset and high-balance account taxation.

The Treasurer characterized his relationship with Keating as an important connection to the superannuation system’s founding principles, emphasizing his role as “custodian of Paul’s creation” in overseeing the retirement savings framework that now manages trillions of dollars for Australian workers.

“I take very seriously the feedback that Paul provides and I value, frankly, the opportunity over a really long period now to engage with Paul Keating, someone who I have a lot of respect for,” Chalmers said.

While declining to provide detailed accounts of their private conversations, Chalmers noted that Keating’s “views are well known” and pointed to the former Prime Minister’s public statement released Tuesday endorsing the reforms as his “first public intervention into this debate.”

Truth matters. Quality journalism costs.

Your subscription to Mencari directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. There is no corporate influence involved. No compromises. Just honest journalism when we need it most.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

The consultation pattern reveals a government seeking validation from Labor’s economic legacy while implementing changes that required navigating complex political dynamics. Keating, who served as Treasurer before becoming Prime Minister in the early 1990s, established the superannuation guarantee system that has become a defining feature of Australia’s retirement landscape.

“You know, as a Labor Treasurer, I take my responsibilities as the custodian of Paul’s creation very seriously,” Chalmers explained. “And that means doing the important changes, making the important reforms to make sure that our superannuation system is as strong and as fair and as sustainable as it can be.”

The current reforms address what Chalmers described as “imperfections” in the system despite its international reputation as a successful retirement savings model. These imperfections include adequacy concerns for low-income earners and women, alongside sustainability questions about tax concessions for individuals with balances reaching tens of millions of dollars.

“Sometimes that’s easy. Sometimes that’s expensive. Sometimes that’s difficult. Sometimes it requires difficult decisions, like the decisions we’ve taken on superannuation tax concessions,” Chalmers said.

The policy process that led to Tuesday’s announcement involved months of discussion not only with Keating but also with Prime Minister Anthony Albanese and other government stakeholders. Chalmers described “a number of conversations over recent months” with Albanese focused on “finding another way to deliver on the objectives of our policy.”

According to Chalmers’ account, he recommended the changes to the government’s Expenditure Review Committee on Friday, with Albanese present for that session. Cabinet formally approved the measures on Monday in Albanese’s absence, and Chalmers proceeded with the public announcement Tuesday.

“The Prime Minister and I have been discussing this for some time. We agreed the changes that I recommended to the Expenditure Review Committee on Friday when he was there,” Chalmers explained. “I got the Cabinet to agree them in his absence on Monday, yesterday. And I thought the best thing was to announce those changes more or less as soon as the Cabinet had agreed them.”

The timeline suggests a deliberate decision to move quickly from Cabinet approval to public announcement, with Chalmers “fronting up” to media to explain the changes immediately after securing government endorsement.

The policy evolution represents what Chalmers characterized as incorporating “a couple of years of feedback” from stakeholders across the superannuation sector. The final framework includes significant modifications from earlier proposals, most notably raising the threshold for enhanced taxation from a previously discussed $3 million to $10 million in account balances.

These adjustments appear to reflect concerns raised through the consultation process, though Chalmers emphasized that the core objectives remained consistent: creating “a fairer, stronger, more sustainable superannuation system.”

“We have taken on board a couple of years of feedback,” Chalmers said. “We work through issues in a considered and a methodical way, and we come up with the best outcome that we can.”

The relationship between current and former Labor treasurers extends beyond superannuation policy, with Chalmers noting that he consults Keating “about the economy more broadly and my job as Treasurer more broadly.” This connection represents a continuation of Labor’s economic policy tradition across generations of leadership.

“You can draw a straight line from Paul through subsequent Labor Treasurers and for this reason,” Chalmers said, acknowledging the intellectual and political lineage connecting contemporary Labor economic policy to the reforms of the 1980s and 1990s.

Keating’s superannuation system, established through compulsory employer contributions, has grown to become one of the world’s largest pools of retirement savings. The system enjoys strong public support and has been maintained with bipartisan backing despite periodic debates about specific parameters and tax treatment.

“Super is the envy of the world,” Chalmers noted. “All around the world, people look at our superannuation system with envy.”

However, the Treasurer acknowledged that international admiration doesn’t preclude the need for ongoing refinement. The current reforms target two specific areas where the system has faced persistent criticism: inadequate balances for lower-income workers and excessive tax concessions for the wealthiest participants.

The expansion of the Low Income Superannuation Tax Offset from $500 to $810 annually, with eligibility rising from $37,000 to $45,000 in income, will benefit 1.3 million workers. Simultaneously, the new 40 percent tax rate on earnings above $10 million addresses concerns about sustainability of concessions for high-balance accounts.

“There are issues around adequacy, particularly for women and low-income earners. We’re addressing that with what we’ve announced,” Chalmers said. “There are issues around the sustainability of the tax concessions for people who might have $30 or $40 or $50 million in super, and we’re addressing that as well.”

The Treasurer’s repeated references to Keating during Tuesday’s announcement signal the government’s desire to position these reforms within Labor’s broader economic legacy. By emphasizing continuity with the system’s original vision while adapting to contemporary challenges, Chalmers aims to build support across Labor constituencies and the broader public.

The political strategy includes direct challenges to the Coalition opposition, with Chalmers arguing that modifications to address their stated concerns eliminate their rationale for Senate opposition. The reforms require legislative passage to take effect, with the government planning to introduce bills in 2026 for implementation beginning in 2027.

Whether Keating’s implicit and explicit endorsement translates to broader political support remains to be seen. The former Prime Minister’s continued influence within Labor circles gives his backing significance, though opposition parties and some affected superannuation account holders may remain skeptical of the reforms regardless of Keating’s position.

Chalmers concluded his remarks on the consultations by reaffirming his ongoing engagement with Labor’s economic tradition: “I’ll always talk to Paul about it as we go.”

Sustaining Mencari Requires Your Support

Independent journalism costs money. Help us continue delivering in-depth investigations and unfiltered commentary on the world's real stories. Your financial contribution enables thorough investigative work and thoughtful analysis, all supported by a dedicated community committed to accuracy and transparency.

Subscribe today to unlock our full archive of investigative reporting and fearless analysis. Subscribing to independent media outlets represents more than just information consumption—it embodies a commitment to factual reporting.

As well as knowing you’re keeping Mencari (Australia) alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting The Evening Post (Australia)

Catch up on some of Mencari’s recent stories:

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!