Australia's housing market shows signs of cooling as investor loans decline

Housing Market Takes Surprising Turn in 2025 as Investment Activity Slows Despite Year-Over-Year Growth

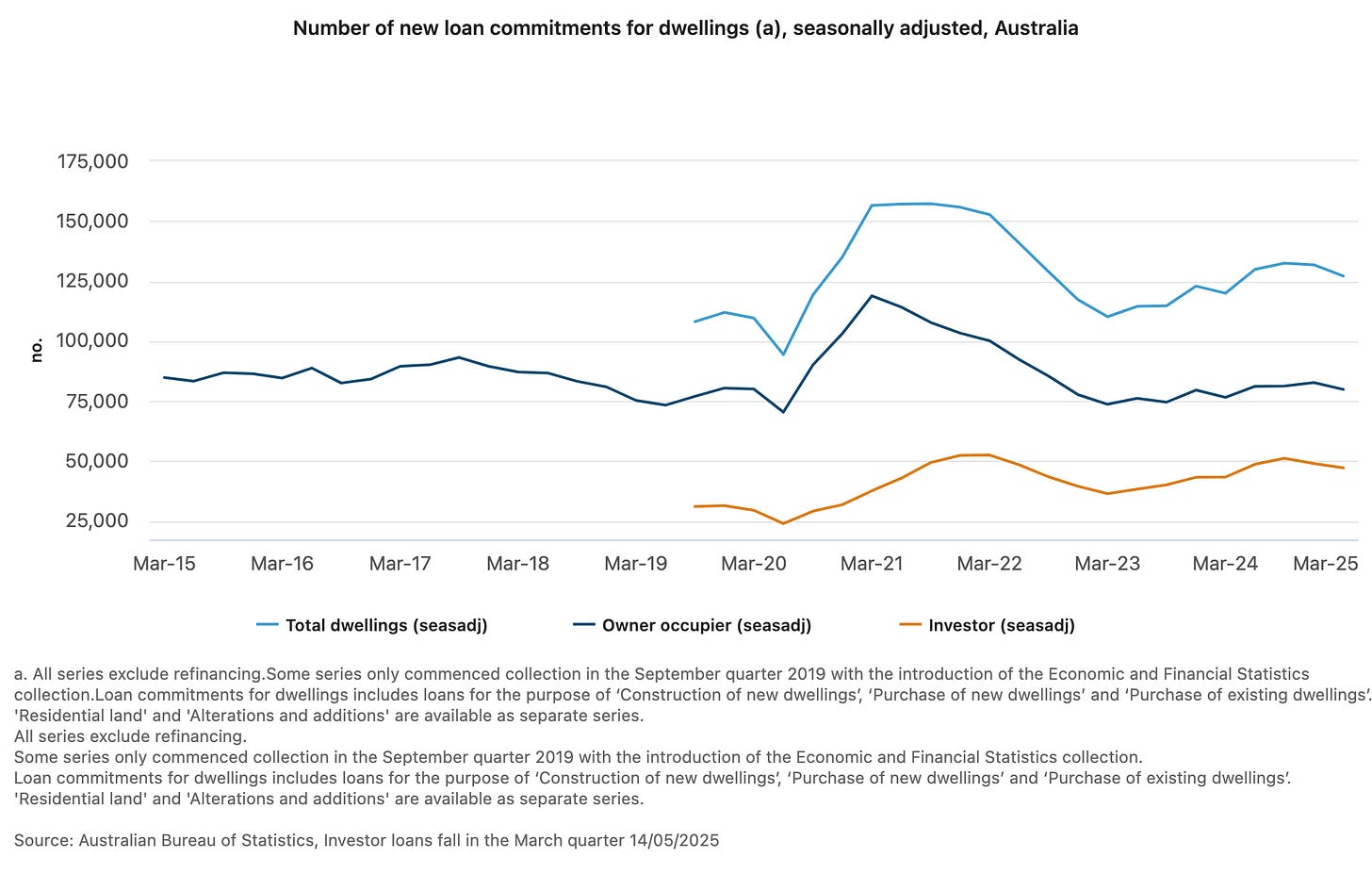

The Australian property market is showing early signs of moderation with both investor and owner-occupier loans decreasing in the March quarter, suggesting a potential shift in market dynamics after strong growth throughout 2024.

According to data released today by the Australian Bureau of Statistics (ABS), investment loans fell by 3.7 percent while new home loans dropped by 3.4 percent, marking the second consecutive quarterly decline in investor activity.

Truth matters. Quality journalism costs.

Your subscription to Mencari directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. No corporate influence. No compromises. Just honest journalism when we need it most.

Key Takeaways:

Investment property loans remain near historic highs despite recent quarterly declines

First home buyers face increasing challenges with a 4.2 percent drop in loan approvals

Refinancing activity surged 5.1 percent as borrowers seek better deals amid changing market conditions

"March quarter's overall fall in lending for dwellings followed strong growth through 2024 and remained higher (+6.0 per cent) compared this time last year," said Dr. Mish Tan, ABS head of finance statistics. The figures reveal the complexity of Australia's housing market, which continues to outperform year-over-year metrics while showing signs of quarterly cooling.

Despite the recent declines, investment activity remains robust from a historical perspective. "While we have seen two consecutive quarters of falls in the value of new investment loans, it remained just below the all-time high seen in March 2022," Dr. Tan noted, highlighting that the investment property market still maintains significant momentum despite the recent pullback.

The data shows regional variations across Australia's property landscape. The decline in investment loans was most pronounced in Western Australia and South Australia, falling 4.3 percent and 3.4 percent respectively. For owner-occupiers, Queensland led the decline with a 2.5 percent reduction in loan approvals, followed by Victoria with a 1.1 percent drop.

Perhaps most concerning for affordability advocates is the continued strain on first-time buyers. The number of owner-occupier first home buyer loans fell by 4.2 percent, representing 1,243 fewer approvals compared to the previous quarter. This decline was widespread across multiple states, with Queensland, South Australia, Western Australia, and Victoria all recording fewer first-time buyer approvals.

The slowdown comes despite average loan sizes decreasing slightly, with owner-occupier loans falling by $6,100 to $659,922 and investor loans dropping by $1,277 to $673,033. This modest reduction in loan sizes has not been sufficient to offset the broader decline in approval numbers.

One bright spot in the data is the continued growth in refinancing activity, with the number of home loans refinanced between lenders increasing by 5.1 percent to 65,030—marking the third consecutive quarterly rise. This suggests homeowners are actively seeking better deals in response to changing market conditions and potentially preparing for future rate adjustments from major lenders like Commonwealth Bank and ANZ.

The total 79,890 new home loans approved in the March quarter, while down from the previous quarter, represents continued weakness compared to historical averages. As Dr. Tan observed, this figure "was lower than the pre-pandemic quarterly average of 84,405 loans between 2015 and 2019," indicating the market has not fully recovered to pre-COVID patterns despite strong price growth in many regions.

What do you think is driving the decline in investment property loans in your local market? Have you noticed a shift in housing affordability in your area? Share your experiences in the comments below.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

As well as knowing you’re keeping MENCARI alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting Mencari's

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!