Australian Wages Rise 3.4% as Chalmers Claims Labor Record, Swipes at Lowe

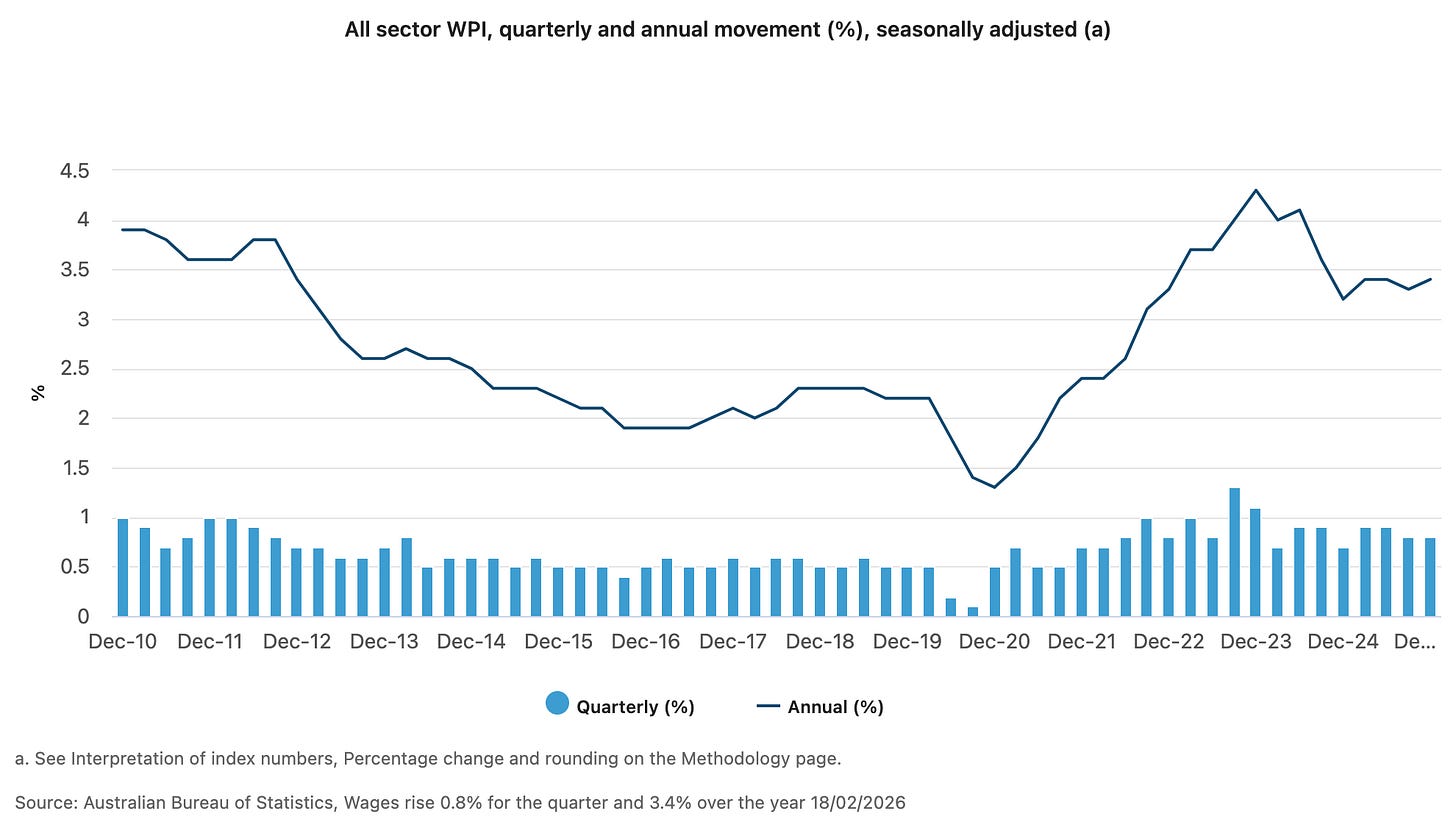

The Wage Price Index held steady for a 14th consecutive quarter above 3%, but higher inflation is squeezing real incomes — and a former RBA governor is adding to the pressure.

This piece is freely available to read. Become a paid subscriber today and help keep Mencari News financially afloat so that we can continue to pay our writers for their insight and expertise.

Today’s Article is brought to you by Empower your podcasting vision with a suite of creative solutions at your fingertips.

Australian wages rose 0.8% in the December quarter and 3.4% over the year, official data showed Wednesday, as Treasurer Jim Chalmers used the result to draw a sharp contrast with the previous government — and take a thinly veiled shot at his sharpest economic critic.

The Australian Bureau of Statistics released the Wage Price Index figures for the December quarter 2025, showing steady quarterly growth that matched the September quarter result. Annual growth ticked up from 3.3% the prior quarter.

“Quarterly wage growth of 0.8 per cent was in line with the September quarter 2025,” said Michelle Marquardt, ABS head of prices statistics. “Annual growth in wages was 3.4 per cent, up from 3.3 per cent in September quarter 2025.”

Speaking in Logan, Queensland, Chalmers seized on the data to highlight what he framed as a defining difference between Labor and the Coalition era.

“14 quarters in a row where we’ve seen wages growth north of 3% — that didn’t happen once in annual terms in the 35 quarters of our predecessors,” Chalmers said. “That’s the difference, really.”

Public Sector Leading the Charge

Public sector wages led annual gains, growing 4.0% in the year to December 2025 — up sharply from 2.8% at the same time in 2024. Private sector wages grew 3.4% over the same period.

Marquardt attributed the public sector surge to new state agreements that delivered multiple rounds of pay rises in 2025. “Multiple pay rises occurred when agreements included backdated increases that took effect soon after the agreement was finalised, and a further scheduled rise was received later in the year,” she said.

In the December quarter itself, both sectors grew at an identical 0.8%. Healthcare and social assistance was the biggest contributor across public and private for the quarter, driven by Commonwealth-funded aged care and early childhood education pay rises in the private sector, and enterprise agreement increases for frontline NSW health workers in the public sector.

The Real Wages Wrinkle

The headline numbers carry a catch. With inflation running higher than the Reserve Bank would like, real wages — the purchasing power workers actually feel — have been eroded despite nominal growth.

Chalmers acknowledged the tension directly. “With inflation higher than we’d like, that has implications for the real wages calculation,” he said, adding that Reserve Bank forecasts point to inflation peaking around mid-year before easing.

The unwinding of Commonwealth energy bill rebates is expected to push headline inflation figures higher in coming months before they moderate — a complicating factor the government will need to navigate heading into the May budget.

Chalmers vs. Lowe

The press conference turned pointed when reporters raised comments from former Reserve Bank Governor Philip Lowe, who told the Australian Financial Review that the government’s economic management had contributed to inflation, low wage growth, and high interest rates.

Chalmers chose his words carefully — but not without a sting.

“Phil Lowe would have liked to have been reappointed by the government. After he wasn’t reappointed, he’s become a fairly persistent critic of the Labor government in the pages of the Financial Review and elsewhere,” Chalmers said. “I think to some extent that’s just human nature.”

He defended the government’s fiscal record point by point. Spending as a share of the economy has fallen from close to a third under Lowe’s tenure to nearer a quarter, Chalmers said, with real spending growth dropping from an average of 4.1% to 1.7%. The government has delivered two budget surpluses, found $114 billion in savings — including $20 billion in December — and cut income taxes for 14 million Australians.

When asked whether he agreed with Prime Minister Anthony Albanese’s characterisation of Lowe as a former official who keeps appearing in the press, Chalmers was blunt. “He’s the former Reserve Bank Governor and he’s got his name in the paper today. I don’t have any issue with what the Prime Minister said.”

What It Means

For younger Australians — the cohort bearing the heaviest load from high rents, elevated mortgage repayments, and rising grocery bills — the data is a mixed picture. Nominal wages are growing, but real purchasing power remains under pressure until inflation returns to target.

Chalmers framed strong wages as part of the solution to cost-of-living pressures, not a driver of them. “Strong and sustainable wages growth is a really important part of our efforts to lift living standards over time,” he said.

With unemployment at 4.1% and the May budget now firmly in preparation, the government’s ability to sustain that argument will depend heavily on whether inflation tracks down in the second half of 2026 — and whether real wages can recover meaningful ground before voters head to the polls.

Sustaining Mencari Requires Your Support

Independent journalism costs money. Help us continue delivering in-depth investigations and unfiltered commentary on the world's real stories. Your financial contribution enables thorough investigative work and thoughtful analysis, all supported by a dedicated community committed to accuracy and transparency.

Subscribe today to unlock our full archive of investigative reporting and fearless analysis. Subscribing to independent media outlets represents more than just information consumption—it embodies a commitment to factual reporting.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week’s newsletter.