Australian Inflation Cools to 2.1%: RBA Relief in Sight? 📉

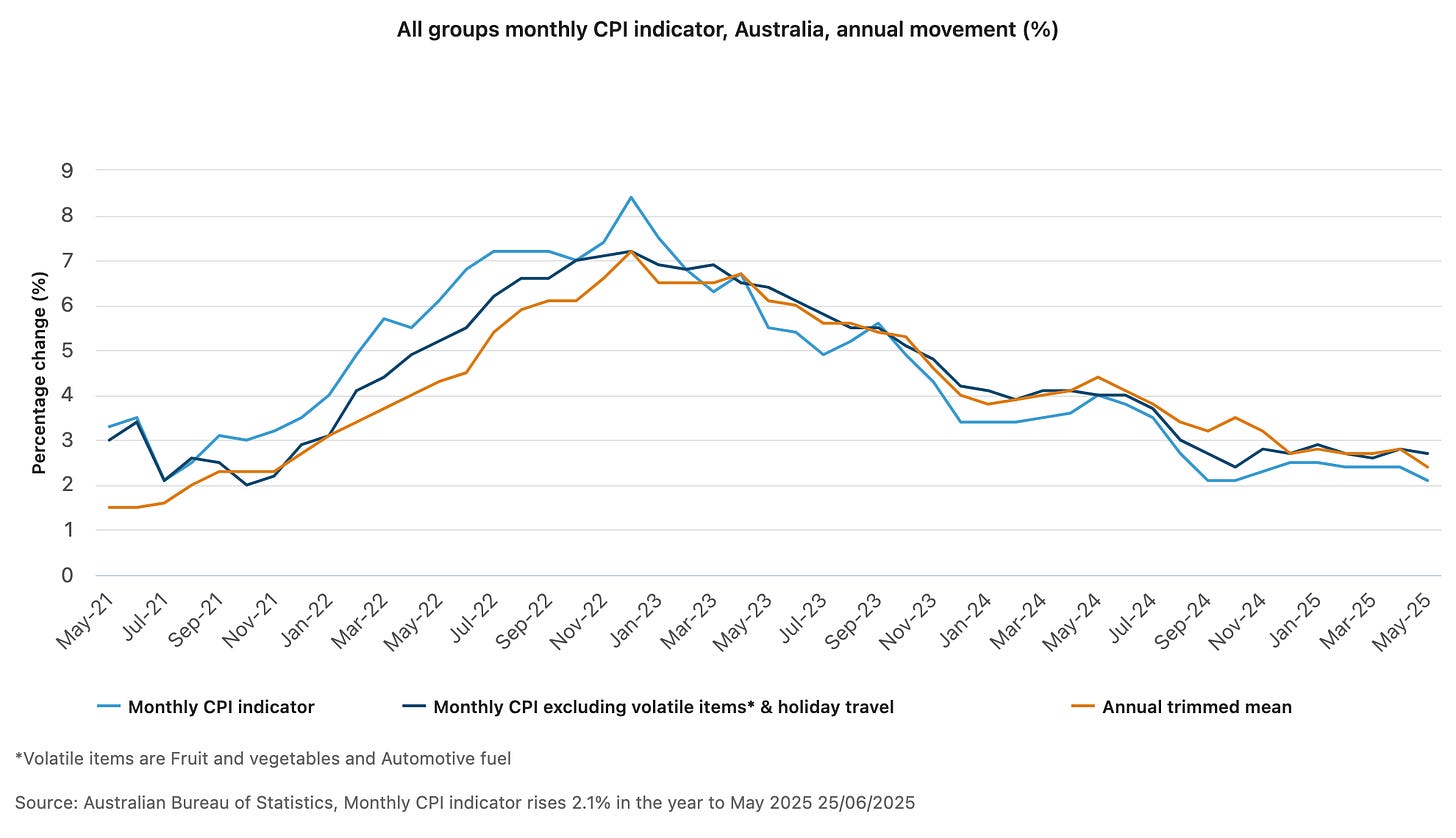

What happened: Australia's monthly Consumer Price Index indicator hit 2.1% annually in May 2025, down from 2.4% in April, marking the lowest inflation reading since October 2024, according to the Australian Bureau of Statistics released today. The trimmed mean—economists' preferred underlying inflation measure—dropped to 2.4%, its lowest level since November 2021.

Truth matters. Quality journalism costs.

Your subscription to The Evening Post (Australia) directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. There is no corporate influence involved. No compromises. Just honest journalism when we need it most.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

Why it matters: This puts Australia tantalizingly close to the Reserve Bank's 2-3% inflation target range, potentially opening the door for interest rate cuts that could ease mortgage stress for millions of households. The moderation comes from exactly where families feel it most: food prices cooling to 2.9% growth (down from 3.1%), rental increases slowing to 4.5% from 5.0%, and petrol averaging $1.73 per litre—20 cents cheaper than a year ago. For mortgage holders paying $3,000+ monthly on average loans, even a 0.25% rate cut could save $50+ per month.

Zoom out: Australia's inflation trajectory now mirrors global trends, with central banks worldwide shifting from aggressive tightening to cautious easing. The rental market slowdown—the first meaningful deceleration since December 2022—suggests housing supply initiatives and migration policy adjustments are finally gaining traction. Meanwhile, government electricity rebates artificially suppressed energy costs by 5.9% (they'd otherwise be up 2.0%), creating a policy-driven inflation buffer that won't last indefinitely.

Bottom line :The Reserve Bank now has cover to consider rate cuts, but the trimmed mean sitting at 2.4% means they'll likely wait for one more confirming data point before acting. Smart money says September becomes the pivot month.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

As well as knowing you’re keeping The Evening Post (Australia) alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting The Evening Post (Australia)

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.