Australian Inflation Climbs to 3.0% as Electricity Costs Surge

Today’s Article is brought to you by Empower your podcasting vision with a suite of creative solutions at your fingertips.

This piece is freely available to read. Become a paid subscriber today and help keep Mencari News financially afloat so that we can continue to pay our writers for their insight and expertise.

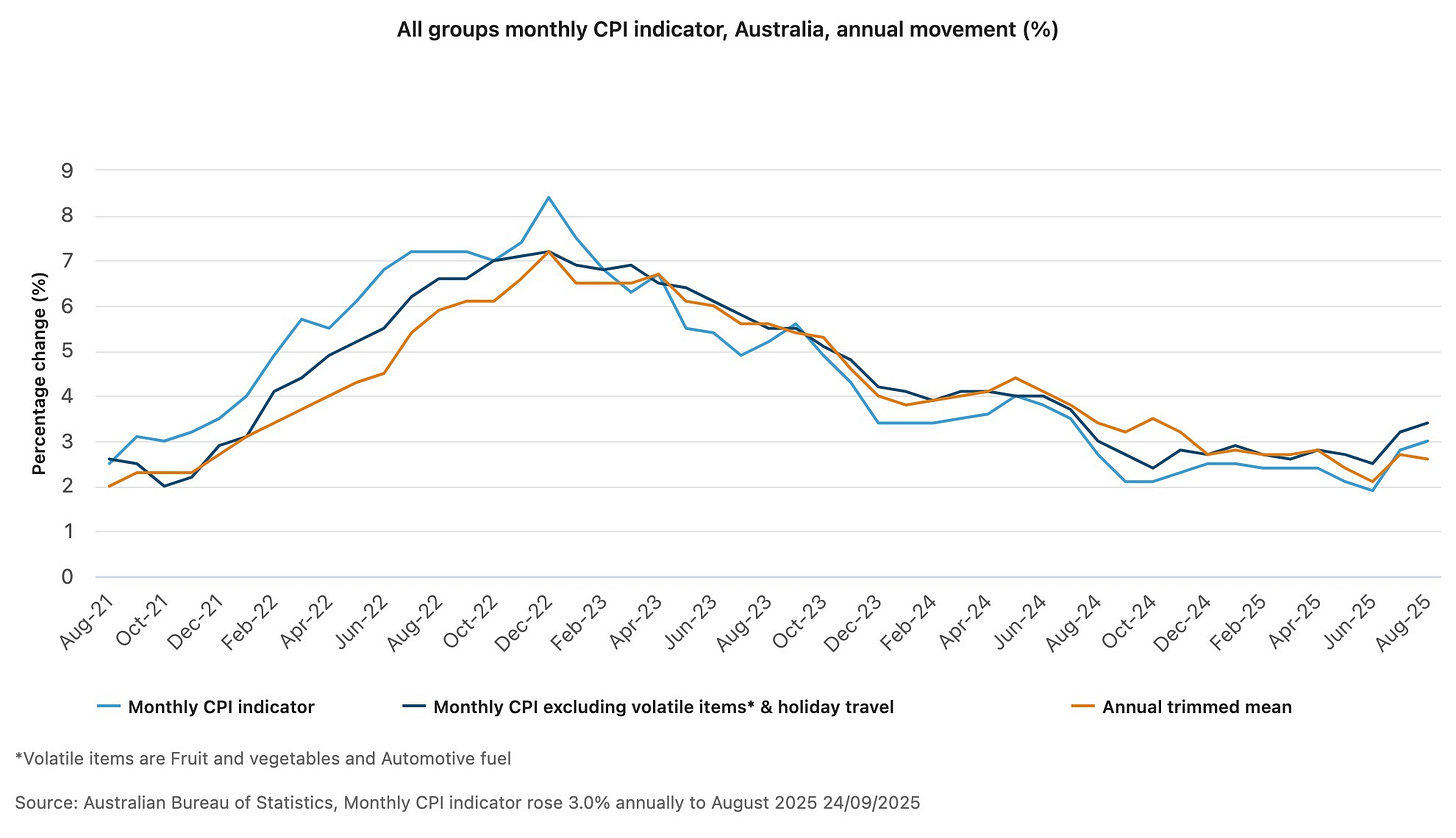

Australian inflation rose to 3.0 percent in the 12 months to August 2025, driven primarily by soaring electricity costs as state government energy rebates expired across multiple jurisdictions, according to data released Wednesday by the Australian Bureau of Statistics.

The August figure represents an increase from 2.8 percent in July and marks the highest annual inflation rate since July 2024. Housing costs led the surge with a 4.5 percent annual increase, followed by food and non-alcoholic beverages at 3.0 percent, and alcohol and tobacco at 6.0 percent.

Electricity costs jumped 24.6 percent over the 12 months to August, primarily affecting households in Queensland, Western Australia and Tasmania where government rebate programs concluded during the measurement period.

“The annual rise in electricity costs is primarily related to households in Queensland, Western Australia and Tasmania having higher out-of-pocket costs in August 2025 than they did in August 2024,” said Michelle Marquardt, ABS head of prices statistics. “In August last year, State Government electricity rebates were in place for Queensland ($1000), Western Australia ($400) and Tasmania ($250). Over the year, those rebates have been used up and those programs have finished.”

Truth matters. Quality journalism costs.

Your subscription to Mencari directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. There is no corporate influence involved. No compromises. Just honest journalism when we need it most.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

Treasurer Welcomes Underlying Trend

Treasurer Jim Chalmers focused on underlying inflation measures during a Brisbane press conference Wednesday, highlighting that the trimmed mean indicator fell to 2.6 percent, down from 2.7 percent in July.

“It is a very good thing to see underlying inflation down to 2.6% around the middle of the Reserve Bank’s target range,” Chalmers said. “Today’s figures show the very substantial and sustained progress that we have made together when it comes to underlying inflation.”

The treasurer emphasized that underlying inflation has remained within the Reserve Bank’s 2-3 percent target range for nine consecutive months, crediting this progress for enabling three interest rate cuts during 2025.

“This progress that we’ve made together on inflation has given the Reserve Bank the confidence that it has needed to cut interest rates three times in the space of six months this year,” Chalmers told reporters.

Housing Costs Drive Headline Inflation

Beyond electricity, housing pressures continued to affect Australian households. Rental prices increased 3.7 percent annually to August, though this represented the lowest annual growth since November 2022. New dwelling prices rose 0.7 percent over the 12 months, reflecting what the ABS described as a subdued new home market.

The statistics bureau noted that stable vacancy rates across most capital cities contributed to the moderation in rental price growth, providing some relief to tenants facing cost-of-living pressures.

Food price inflation remained steady at 3.0 percent annually, unchanged from July. However, significant variations emerged within food categories, with meat and seafood prices rising 2.9 percent while fruit and vegetable prices increased just 1.1 percent after vegetables fell 4.6 percent in August alone.

Political Divisions Over Energy Policy

The inflation figures emerged alongside renewed political debate over Australia’s energy transition, triggered by U.S. President Donald Trump’s United Nations address calling climate change “the greatest con job ever perpetrated on the world.”

Chalmers deflected direct criticism of Trump’s stance while defending Australia’s renewable energy strategy during his press conference.

“Donald Trump’s comments, President Trump’s comments are a matter for him. His views are a matter for him,” Chalmers said. “Our job is to work through the Australian opportunity in an Australian way.”

The treasurer argued that Australia’s clean energy transition represents “a massive economic opportunity” as global investors seek destinations for renewable energy investment.

Opposition Voices Concern Over Renewable Investments

Former Deputy Prime Minister Michael McCormack criticized the government’s approach to renewable energy investments during a Sky News interview Wednesday, highlighting concerns about foreign investment oversight.

McCormack pointed to a stalled wind farm project between Binalong and Bowning as evidence of inadequate due diligence, revealing that the overseas investor had “been operating in the UK insolvent for eight years.”

“The Prime Minister and Chris Bowen, for God’s sake, Chris Bowen is over in the United States at the moment, looking for investors to invest in clean green, supposedly, energy projects in Australia,” McCormack said. “They’re selling Australia out.”

The Nationals MP expressed skepticism about renewable energy projects in rural areas, citing concerns about agricultural land use and emergency response capabilities for battery storage systems.

Reserve Bank Considerations

The mixed inflation signals present challenges for Reserve Bank monetary policy deliberations. While underlying inflation remains within the target range, headline inflation’s persistence above 3 percent reflects ongoing cost-of-living pressures for Australian households.

Chalmers acknowledged that monthly inflation figures carry inherent volatility compared to quarterly measurements, referencing recent Reserve Bank Governor comments about the reliability of different inflation measures.

“Monthly inflation figures can be more volatile and less reliable than the quarterly figures because they don’t compare the exact same basket of goods and services from month to month,” the treasurer said.

Global Context

Australia’s inflation trajectory contrasts with developments in other advanced economies, where price pressures have intensified in recent months.

“We also need to remember that these results today and recent inflation data has come at a time when inflation has ticked up in other parts of the world, including the US, Canada and New Zealand, and it’s still stubbornly high in places like the United Kingdom as well,” Chalmers noted.

The treasurer positioned Australia’s relatively stable underlying inflation as evidence of effective economic management amid global uncertainty.

Tax System Reform Initiative

Alongside the inflation commentary, Chalmers announced a new initiative targeting business compliance costs, tasking the Board of Taxation with identifying “responsible and affordable ways to cut compliance costs in the tax system by cutting red tape.”

The review represents part of broader regulatory reform efforts aimed at reducing administrative burdens on Australian businesses while maintaining appropriate oversight mechanisms.

Energy Market Dynamics

The electricity price surge reflected complex interactions between state and federal rebate programs across Australian jurisdictions. While Queensland, Western Australia and Tasmania experienced significant cost increases as rebate programs expired, New South Wales and ACT households received relief through extended Commonwealth Energy Bill Relief Fund payments.

“Excluding the impact of the various changes in Commonwealth and State electricity rebates over the last year electricity prices rose 5.9 percent,” Marquardt explained, highlighting the substantial influence of government intervention on headline inflation figures.

Monthly electricity costs fell 6.3 percent in August as NSW and ACT households received their first payments under extended rebate arrangements, demonstrating the immediate impact of government energy relief measures.

The August inflation data underscores ongoing challenges in balancing cost-of-living relief with broader economic stability objectives as Australia navigates competing domestic priorities amid global economic uncertainty.

Sustaining Mencari Requires Your Support

Independent journalism costs money. Help us continue delivering in-depth investigations and unfiltered commentary on the world's real stories. Your financial contribution enables thorough investigative work and thoughtful analysis, all supported by a dedicated community committed to accuracy and transparency.

Subscribe today to unlock our full archive of investigative reporting and fearless analysis. Subscribing to independent media outlets represents more than just information consumption—it embodies a commitment to factual reporting.

As well as knowing you’re keeping Mencari (Australia) alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting The Evening Post (Australia)

Catch up on some of Mencari’s recent stories:

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!