Good morning! It's Wednesday, 5 June. Welcome to INSIDE AUSTRALIA, where you'll find all the latest business and financial news, plus our take on what's going on around the world.

Today, we're going to chat about the steel tariff and some penalties from two of Australia's biggest companies.

Please support us and spread the word to your family and friends about our newsletter. As always, contact us via email and don't forget to sign up for this newsletter here if you haven't already!

We'd love it if you could share the email with your friends! Just (copy the URL here.

In today’s email:

Australian Economy Signals Cautious Resilience Amid Weather Disruptions

ASIC Sues Westpac Subsidiary RAMS Over Systematic Home Loan Fraud.

Super Tax Standoff: Treasurer Rules Out Compromise Despite PM's Openness

Coalition Demands Steel Tariff Exemption After UK Secures Deal with US

Today's reading time is 7 minutes. - Miko Santos

MARKET CLOSE: 4 JUNE 25

After a solid lead from Wall Street and softer than expected GDP data, the Australian share market pushed higher for a second day most sectors improving.

Data is provided by CommSec. Stock data as of At close 04/06 (AEST)

Australian Economy Signals Cautious Resilience Amid Weather Disruptions

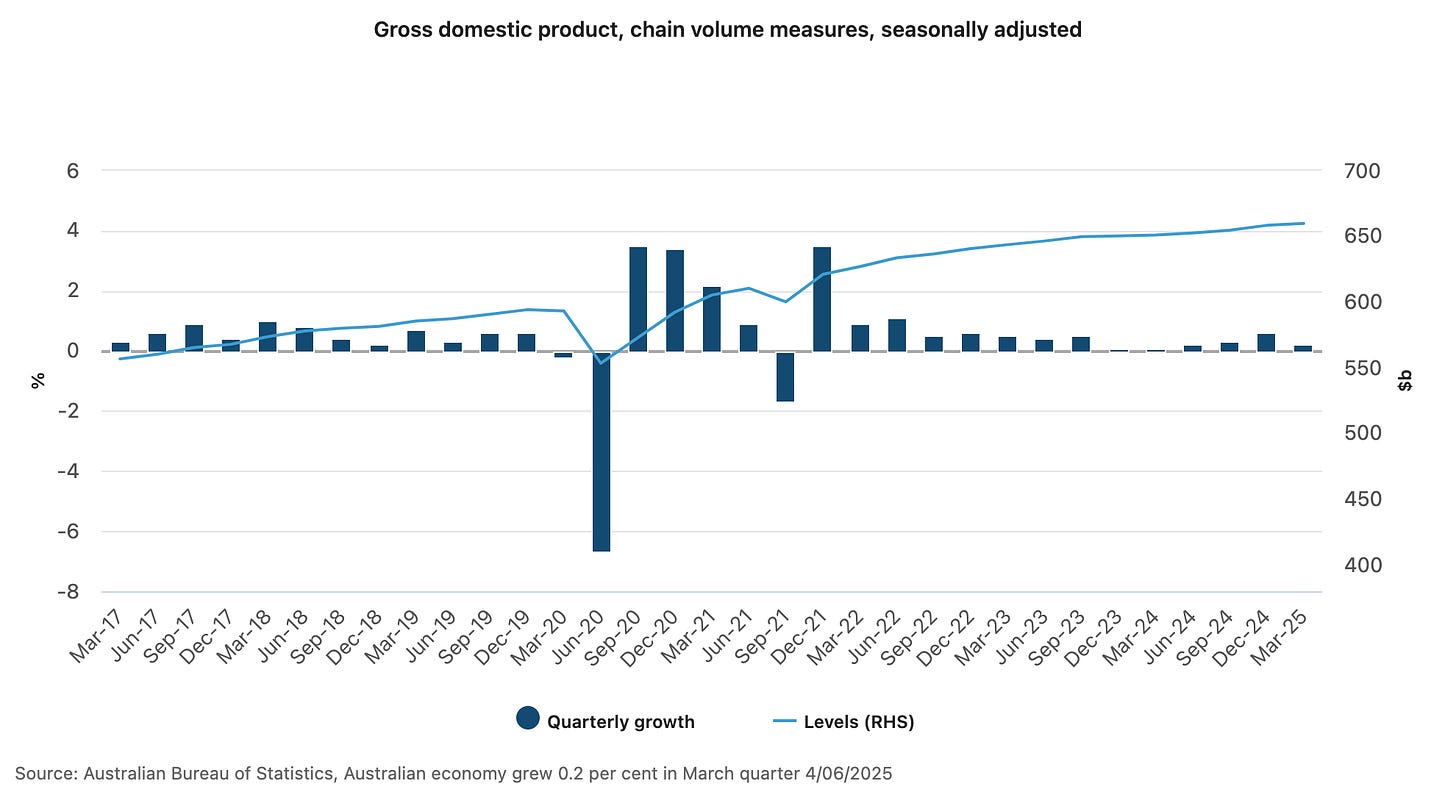

What happened: Australia's GDP crawled forward 0.2% in the March 2025 quarter, reaching 1.3% annual growth, according to fresh Australian Bureau of Statistics data released today. The sluggish quarterly performance reflects a confluence of extreme weather impacts, flat government spending, and shifting household behavior that's reshaping the economic landscape.

Why it matters: This represents Australia's economic reality check—growth that's technically positive but practically underwhelming. GDP per capita actually declined 0.2%, meaning the average Australian is marginally worse off despite headline growth. More revealing: households are dramatically increasing their savings rate to 5.2%, up from 3.9% last quarter, signaling either growing economic anxiety or strategic financial positioning ahead of uncertain times.

The weather disruption story cuts deeper than typical seasonal variations. Coal and LNG exports—Australia's economic backbone—took substantial hits from severe weather affecting both production and shipping. When your primary export industries stumble due to climate events, it's not just a quarterly blip; it's a preview of structural challenges facing resource-dependent economies.

Zoom out: Australia finds itself navigating three converging trends that define modern economic management. First, the household savings surge reflects post-pandemic financial behavior that's becoming permanent—people are prioritizing financial buffers over consumption. Second, government spending has plateaued after years of stimulus, marking a shift toward fiscal restraint that's rippling through growth metrics. Third, climate-related disruptions are moving from occasional inconveniences to regular economic factors requiring systematic planning.

The international student revenue decline adds another layer of complexity. Australia's education export industry—historically a reliable growth driver—is showing signs of saturation or policy-induced slowdown, removing a key economic pillar just as other sectors face headwinds.

Private investment showed resilience with 0.7% growth, driven by housing and infrastructure projects. This suggests business confidence remains intact despite broader economic softness, potentially indicating that private sector actors see opportunities where headline numbers suggest caution.

Market Implications:

Australian dollar faces downward pressure as growth disappointments mount

Reserve Bank of Australia's February rate cut appears well-timed given emerging weakness

Resource sector volatility likely to persist given climate impact frequency

Consumer discretionary spending patterns shifting toward essential categories

Worth watching: How quickly weather-disrupted export capacity recovers and whether the household savings surge represents temporary caution or permanent behavioral change. The intersection of climate resilience planning and economic policy will increasingly determine Australia's growth trajectory.

Bottom line: Australia's economy is demonstrating cautious resilience rather than robust expansion. The 0.2% growth figure masks a more complex story of households building financial defenses, weather events reshaping export reliability, and government stepping back from growth support. This isn't economic crisis—it's economic adaptation to a more volatile operating environment.

The real test lies ahead: whether Australia can maintain stable growth while simultaneously building climate resilience, managing shifting global demand for its resources, and supporting households through what appears to be a prolonged period of modest expansion. Current indicators suggest the economy is choosing stability over speed, which may prove prescient given global uncertainties.

For investors and policymakers, this data confirms that Australia's economic future depends less on traditional growth levers and more on adaptive capacity—the ability to maintain steady progress despite increasing environmental and structural disruptions.

BIG PICTURE

➡️ ASIC Sues Westpac Subsidiary RAMS Over Systematic Home Loan Fraud. Australia's financial regulator ASIC is taking legal action against RAMS Financial Group, a Westpac subsidiary, for systematic misconduct in home loan arrangements between 2019-2023, including fake documents and inadequate supervision that allowed unqualified borrowers to receive loans.

➡️ ACMA Penalizes Telstra Over Disability Emergency Call Service Disruption During Server Upgrade. Australia's telecommunications regulator ACMA fined Telstra $18,780 after the company accidentally disabled the 106 emergency call relay service used by people with hearing and speech impairments for nearly 13 hours during a July 2024 server migration, marking another failure in the telco's emergency service obligations.

➡️ Australia's $68 Billion Crime Crisis: AUSTRAC Expands Financial Regulations to Target Lawyers and Real Estate Agents. Australia's financial intelligence agency AUSTRAC will impose new anti-money laundering obligations on 80,000 businesses including lawyers, accountants, and real estate agents from July 2025, targeting the $68 billion annual cost of organized crime that exploits regulatory gaps in professional services to launder illicit funds.

Super Tax Standoff: Treasurer Rules Out Compromise Despite PM's Openness

What happened: Treasurer Jim Chalmers today rejected any compromise on Labor's controversial superannuation tax reforms, directly contradicting Prime Minister Anthony Albanese's apparent willingness to negotiate on the policy just one day earlier.

Speaking after releasing March quarter GDP figures, Chalmers defended the government's plan to tax unrealized capital gains on super balances above $3 million, dismissing Coalition calls for changes to the calculation method. "We've given people multiple opportunities to propose alternatives to this calculation," Chalmers said. "Treasury proposed it to us. We did multiple rounds of consultation."

The comments put Chalmers at odds with Albanese, who reportedly indicated yesterday he was open to compromising on elements of the super tax policy.

Shadow Treasurer Ted O'Brien immediately seized on the apparent division, telling reporters: "Only yesterday we had the Prime Minister saying that he is willing to compromise on their superannuation tax, which includes unrealised capital gains. But today we have the Treasurer saying there's no hope that he will be compromising on that policy."

O'Brien described Labor's policy as "super big and super bad," arguing it would damage the Australian economy through both direct effects and "second-order effects."

Why it matters: The superannuation tax has become a major political battleground, with the Coalition positioning it as a key attack line against the government. The apparent disagreement between Labor's two most senior economic figures signals potential internal tensions over one of their signature policies reforms.

Chalmers used the press conference to clarify that Prime Minister Albanese and other politicians on defined benefit schemes are included in the tax changes, addressing claims they would be exempt. "We've had people, I think shamefully, say that the Prime Minister or other senior politicians at the federal level on defined benefits are somehow exempt from this change. They are not," he said.

Zoom out: The super tax controversy reflects broader challenges facing the government as it attempts to balance budget repair with political sustainability. The policy affects only an estimated 80,000 Australians with super balances exceeding $3 million, but has generated significant opposition from industry groups and the Coalition.

Bottom line: With the Coalition ruling out any support and internal Labor messaging appearing fractured, the government faces an uphill battle to pass the legislation through a hostile Senate.

Coalition Demands Steel Tariff Exemption After UK Secures Deal with US

Coalition Demands Steel Tariff Exemption After UK Secures Deal with US

What happened: The Coalition is demanding Prime Minister Anthony Albanese secure Australia a steel tariff exemption from the United States, following reports that the UK negotiated to maintain 25% levies on its steel imports rather than face higher rates.

Shadow Trade Minister Kevin Hogan criticized the government's approach to the Trump administration, revealing Australia exports only "1% of our overall steel production" to the US but warning of broader economic consequences from escalating trade tensions.

"I firmly believe that Trump's tariff policies is bad policy, obviously for us, for the global growth, global trade, but also for the American consumer," Hogan told reporters. "It just makes everything more expensive for them."

The UK deal, struck last month, allows current 25% levies to remain in place, though they could rise in July if key conditions aren't met.

Why it matters: Australia's steel industry faces potential disruption from US trade policies, with some producers having American operations potentially benefiting while exports could suffer. The issue highlights broader concerns about Australia's diplomatic engagement with the Trump administration.

Hogan revealed Albanese has not held a face-to-face meeting with President Trump "seven months in since the president's been elected," arguing this puts Australia at a disadvantage in securing favorable trade terms.

"We do want the Prime Minister to get on the front foot, have a physical meeting," Hogan said. "We need to get on the front with that, you know, sell that story well very forcefully."

Zoom out: The steel tariff dispute reflects wider tensions around Trump's protectionist trade agenda and its impact on traditional US allies. Australia's position as both a security partner through AUKUS and a major commodity exporter creates complex dynamics in trade negotiations.

Hogan emphasized Australia shouldn't accept quid pro quo arrangements, arguing the country's national security contributions and reliable supply chains should warrant preferential treatment without strings attached.

"We can be a really reliable partner with some of the critical minerals and other things that people want," he said. "There's a holistic way we can look at this, but it certainly shouldn't be quid pro quo."

Bottom line: With global trade tensions escalating and allies securing separate deals, Australia faces pressure to strengthen diplomatic engagement with Washington to protect its economic interests.

SUPPORT MENCARI

The Mencari - Australia's Politics delivers fact-focused reporting to over 1,000 inboxes thanks to readers like you, and your contribution today will strengthen our ability to provide verified, evidence-based journalism completely free from financial or political influence as we work to establish ourselves as Australia's premier independent news organization focused on accountability through thorough investigation.

As well as knowing you’re keeping MENCARI alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting Mencari's

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

FROM OUR TEAM

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

🎧 Check out our podcasts. This podcast seeks the truth to answer the most pressing questions using the highest journalistic standards

✍️ Give us a press release and a good-sized landscape photo. Make sure it's newsworthy. Send press releases to newsdesk@readmencari.com or click here. Editorially, we may rewrite headlines and descriptions.

🚀 Got a news tip ? Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn. You can securely message him on Signal by using his username, Miko Santos.