ASIC Seeks Record $240 Million Penalty Against ANZ for Unconscionable Conduct in Government Bond Deal

Today’s email is brought to you by Empower your podcasting vision with a suite of creative solutions at your fingertips.

The Australian Securities and Investments Commission will ask the Federal Court to impose a record $240 million penalty against ANZ following the bank's admission to unconscionable conduct in a $14 billion government bond deal and widespread misconduct affecting nearly 65,000 customers.

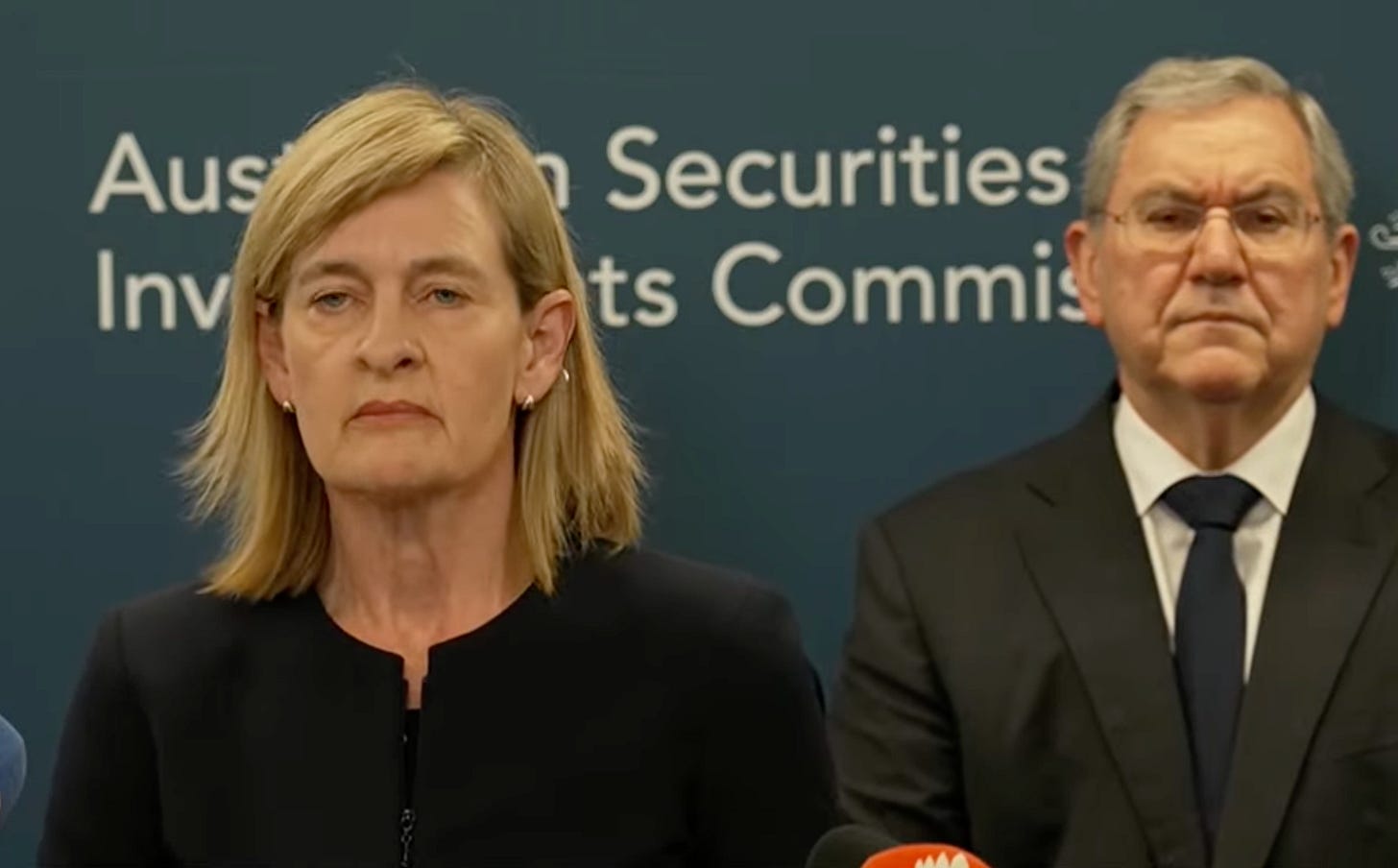

ASIC Chair Joe Longo announced Monday the penalties represent the largest regulatory action ever taken against a single entity, spanning four separate proceedings involving ANZ's institutional and retail banking divisions.

"Time and time again ANZ has fallen short. Time and time again ANZ has betrayed the trust of Australians," Longo said during a media conference in Sydney. "The issues we have found in the bank's different divisions are a mix of widespread misconduct, repeated failures and an unacceptable disregard for the trust customers put in banks."

The most serious charge involves ANZ's role as duration manager for the Australian Office of Financial Management's $14 billion bond issuance on April 19, 2023, with ASIC alleging the bank's trading cost the government $26 million.

Truth matters. Quality journalism costs.

Your subscription to Mencari directly funds the investigative reporting our democracy needs. For less than a coffee per week, you enable our journalists to uncover stories that powerful interests would rather keep hidden. There is no corporate influence involved. No compromises. Just honest journalism when we need it most.

Not ready to be paid subscribe, but appreciate the newsletter ? Grab us a beer or snag the exclusive ad spot at the top of next week's newsletter.

Record Unconscionable Conduct Penalty

The $240 million penalty package includes a record $80 million for unconscionable conduct, the largest such penalty ASIC has ever sought. ANZ sold significant volumes of 10-year Australian bond futures around pricing time, placing downward pressure on bond prices while failing to inform the government client about remaining positions.

"ANZ was chosen by the Australian Government to help deliver a $14 billion bond deal. This is a prestigious and trusted role," Longo said. "ASIC's position is that ANZ's misconduct potentially made the Government $26 million worse off."

The $26 million calculation reflects a two basis point decrease in bond futures prices over 45 minutes of ANZ's most active trading before pricing, according to ASIC.

"A lower price for the bond meant the government raised less funds – money that might have been used to support essential services including Australia's health and education systems, affecting all Australians," Longo said. "When public funds are put at risk like this, every Australian pays the price."

ANZ disputes ASIC's loss calculation but agreed to the penalty. The bank also admitted to submitting inaccurate monthly bond turnover data to AOFM over nearly two years, inflating figures by tens of billions of dollars.

Executive Accountability and Apologies

ANZ Chairman Paul O'Sullivan issued a public apology while announcing significant executive accountability measures.

"While we have worked hard to get regulatory certainty on these matters, the reality is we made mistakes that have had a significant impact on customers," O'Sullivan said. "On behalf of ANZ, I apologise and assure our customers we have taken the necessary action, including holding relevant executives accountable."

Chief Executive Nuno Matos acknowledged systemic failures requiring comprehensive changes.

"The failings outlined are simply not good enough and they reinforce the case for change," Matos said. "It is my expectation that we see measurable improvements across the bank to better protect and care for our customers and to create a more sustainable business."

The bank completed more than 50 accountability reviews resulting in significant executive remuneration reductions, with additional measures planned through this year's compensation review process.

Retail Banking Violations

ASIC Deputy Chair Sarah Court detailed three retail banking matters affecting vulnerable customers across multiple service areas.

Between May 2022 and September 2024, ANZ failed to respond to 488 customer hardship notices, with some cases unresolved for over two years despite customers reporting unemployment, medical issues, bereavement and family violence.

"Whether it was a customer facing unemployment, recovering from serious illness, grieving the loss of a loved one or escaping family violence, ANZ left these people without the help that they were asking for," Court said. "In some cases, the bank pursued debt recovery even before acknowledging these hardship pleas."

The bank took debt collection actions including default notices and external agency referrals against customers whose hardship applications remained unanswered.

Interest Rate and Fee Failures

From July 2013 to January 2024, ANZ's system deficiencies prevented proper application of bonus interest rates on savings accounts, requiring remediation of 194,487 accounts representing 7.26 percent of new accounts opened during that period.

"ANZ failed at another core job of banking, paying the correct interest rate," Court said. "ANZ promoted misleading bonus interest offers on new savings accounts and then underpaid tens of thousands of customers once they had them through the door."

A separate issue between August 2024 and March 2025 affected 56,703 customers, with ANZ failing to pay correct interest amounts to 26,917 customers, resulting in approximately $480,000 in unpaid interest.

Between July 2019 and June 2023, ANZ's systems failed to identify appropriate fee waivers and refunds after customer deaths, continuing to charge thousands of deceased customers while failing to respond to estate representatives within required timeframes.

"In the most sensitive of circumstances, the handling of deceased estates, ANZ failed to refund fees charged to thousands of customers who had died and failed to respond to their grieving families in a timely manner," Court said. "These failures by ANZ likely made a difficult time even tougher and compounded the distress these families were facing."

Pattern of Repeat Offenses

Including Monday's announcement, ASIC has brought 11 civil penalty proceedings against ANZ since 2016, with total penalties exceeding $310 million.

"We have been here before with ANZ," Longo said. "The bank has a history of non-compliance in markets matters for misconduct in foreign exchange, continuous disclosure, and the bank bill swap rate matter."

Previous violations include a $25 million penalty in 2022 for 155,868 contraventions over 20 years for failing to provide promised customer benefits, $15 million in 2023 for misleading credit card customers, and $10 million penalties for responsible lending breaches and unconscionable periodic payment fees.

Court emphasized the broader regulatory message beyond ANZ's specific failures.

"It's now more than five years since the Banking Royal Commission, but disappointingly here we are, yet again, with not one but four more examples of how ANZ has fallen short," she said.

Technical Bond Trading Explanation

Longo provided detailed explanation of the bond trading violations for general audiences, emphasizing the practical impact on government funding.

"What happened here is that we had four sophisticated banks helping the Commonwealth manage all the risk and making sure this debt gets bought so that the money can be raised," he said. "ANZ's job was to manage the interest rate risk around a transaction of this size."

The unconscionable conduct involved ANZ failing to follow its own policies and procedures while not keeping AOFM informed about its trading activities.

"They said they were going to be frank in their communication with AOFM. They weren't. They said they were going to follow their own policy and procedures. They didn't," Longo said. "The practical effect of it is that the Commonwealth ended up having to pay more to raise this money than it needed to."

ANZ was not transparent about significant futures positions it intended to sell around pricing time, denying the government opportunity to adjust timing or protect itself from market impact.

Comprehensive Remediation Program

ANZ established an ASIC Matters Resolution Program within its retail division to deliver improvements across breach reporting, event management, customer remediation and complaints handling.

The bank appointed Promontory as independent expert to review program adequacy and assess whether ANZ delivers regulatory commitments.

ANZ will submit its Root Cause Remediation Plan to the Australian Prudential Regulation Authority by September 30, expecting to spend approximately $150 million implementing the plan in fiscal year 2026.

"ANZ needs to prioritise the management of non-financial risk so it can step up and do better by its customers," Court said.

The remediation plan follows an enterprise-wide independent review identifying persistent weaknesses in non-financial risk management across culture, capabilities, accountability, governance, policies and execution.

Regulatory Deterrence Objectives

ASIC officials emphasized the penalties must serve as industry-wide deterrence rather than acceptable business costs.

"If these penalties are imposed by the court, it should be a clear message to ANZ and all other banks that the cost of breaking the law is not an acceptable cost of doing business," Court said.

Longo stressed the unconscionable conduct charge represents serious commercial misconduct warranting substantial penalty despite ANZ's characterization focusing on technical trading issues.

"This is very serious, unconscionable conduct," he said. "So I think it's rather curious that people should be concerned about market manipulation. It's serious enough that we've found a contravention that's been admitted to unconscionable conduct."

The ASIC investigation spanned nearly two years with market experts and senior counsel examining evidence across multiple bank divisions and transaction types.

Customer Impact Assessment

The retail banking violations affected customers during particularly vulnerable circumstances, with ANZ's failures compounding existing hardships.

Over 18,900 customer accounts received $3.8 million in remediation for unintended fees and delay-related costs, with over 9,000 people contacted for apologies regarding deceased estate handling delays.

For hardship matters, ANZ completed remediation including $92,687 in customer payments and corrections to credit reports for affected individuals.

Matos acknowledged the timing of failures during customer vulnerability.

"Unfortunately, some of our failings occurred when our customers were at their most vulnerable," he said. "For this we are deeply sorry, and we are making changes to better support our customers when they need us most."

Future Oversight Expectations

Longo confirmed intensified ASIC monitoring of ANZ's compliance and remediation efforts following the comprehensive settlement.

"We will continue to have intense institutional monitoring engagement with ANZ, as we do more or less, I might add, with all the banks, but in particular with ANZ at the moment," he said.

The regulator expects to closely monitor ANZ's implementation of promised changes over the next one to two years.

"Given the seriousness and breadth of the issues that we're dealing with today, you can expect ASIC to be watching very closely over the next year or two to see that ANZ actually does do what it says it's going to do," Longo said.

Each of the four matters requires separate Federal Court consideration for penalty approval and additional orders. The court must determine whether proposed penalties appropriately reflect the scope and seriousness of ANZ's admitted misconduct across institutional and retail banking operations.

The settlement establishes new benchmarks for regulatory accountability in Australia's banking sector, emphasizing unacceptable costs of compliance failures that undermine public trust in financial institutions.

Sustaining Mencari Requires Your Support

Independent journalism costs money. Help us continue delivering in-depth investigations and unfiltered commentary on the world's real stories. Your financial contribution enables thorough investigative work and thoughtful analysis, all supported by a dedicated community committed to accuracy and transparency.

Subscribe today to unlock our full archive of investigative reporting and fearless analysis. Subscribing to independent media outlets represents more than just information consumption—it embodies a commitment to factual reporting.

As well as knowing you’re keeping Mencari (Australia) alive, you’ll also get:

Get breaking news AS IT HAPPENS - Gain instant access to our real-time coverage and analysis when major stories break, keeping you ahead of the curve

Unlock our COMPLETE content library - Enjoy unlimited access to every newsletter, podcast episode, and exclusive archive—all seamlessly available in your favorite podcast apps.

Join the conversation that matters - Be part of our vibrant community with full commenting privileges on all content, directly supporting The Evening Post (Australia)

Catch up on some of Mencari’s recent stories:

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!