📰 2025 Payment Trends Reveal Critical Trust Gaps in Australian Ecommerce Experience

The 2025 E-Commerce Payments Experience Report exposes important information that retailers cannot afford to overlook in a fast changing digital market where payment experience can define or break consumer loyalty.

Businesses have hitherto unheard-of difficulties building seamless checkout experiences across several channels as traditional and flexible payment options fight for consumer choice and trust becomes the ultimate currency.

Key Highlights

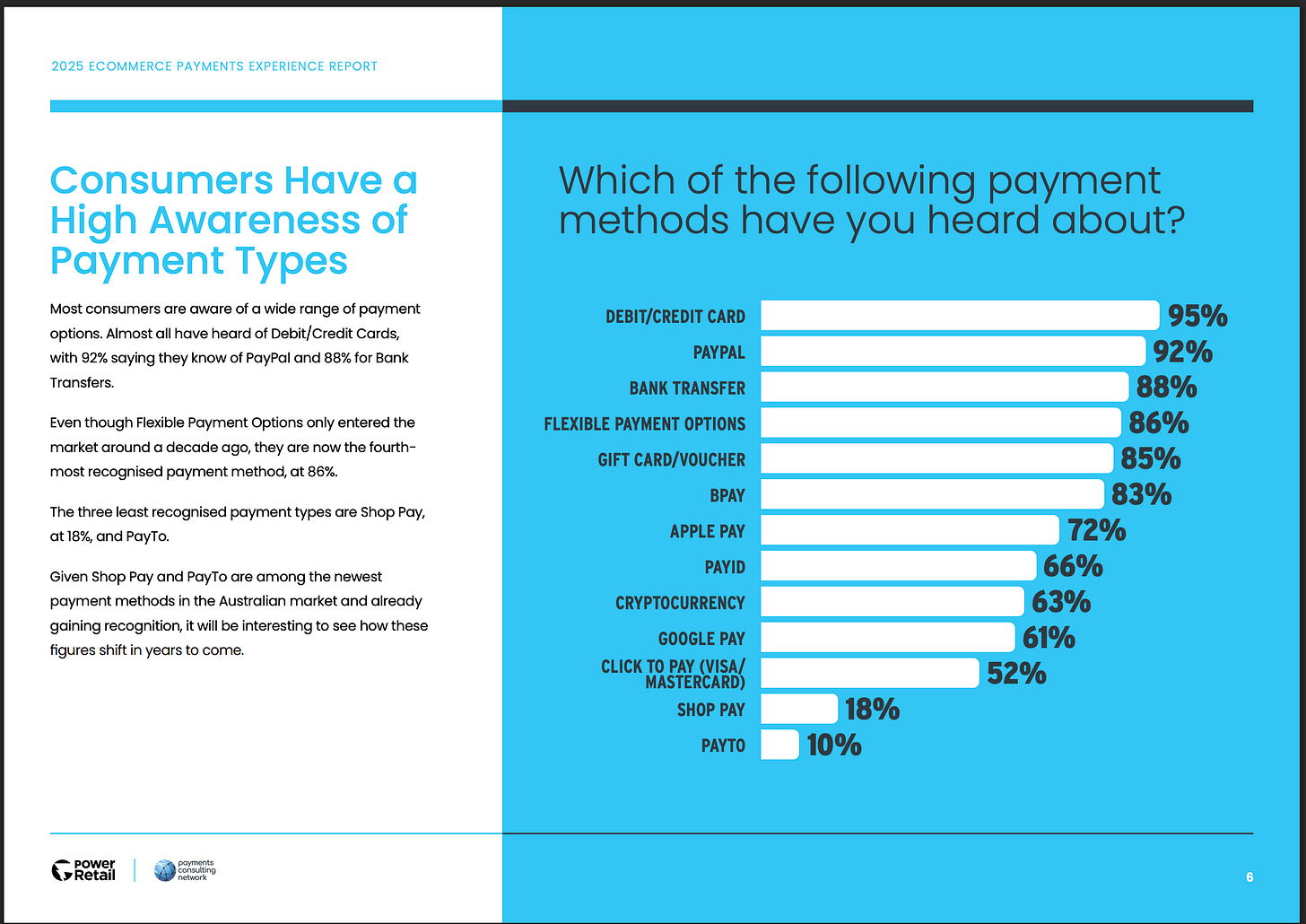

Debit/Credit Cards remain dominant payment methods, but Flexible Payment Options have gained significant traction, especially among younger consumers

Nearly 40% of consumers now rely on lines of credit for online purchases, reflecting shifting financial behaviors amid economic pressures

Trust concerns prompt 58% of consumers to shop exclusively with familiar brands, while security issues cause 12% of cart abandonments

High shipping costs continue to be the leading cause of abandoned carts, affecting 40% of online shoppers

Understanding the Payments Landscape

The comprehensive report, sponsored by Stripe and Zip, surveyed 1,031 Australian consumers to analyze their payment preferences and behaviors. While debit and credit cards remain the primary payment method used by 78% of consumers, the landscape has diversified significantly, with PayPal capturing 51% of transactions and newer options like Buy Now Pay Later (BNPL) services gaining substantial market share.

"Enabling consumers to pay how they want leads to higher conversion rates and should be top of mind for retailers," explains Mangala Martinus, Managing Director of Payments Consulting Network. "The current cost of living pressure and the interest-free benefits of Flexible Payment Options means they have become an important payment method for many."

Why It Matters

For retailers and marketplaces, understanding consumer payment preferences directly impacts bottom-line results. With 40% of consumers abandoning carts due to high shipping costs and 17% leaving when encountering hidden fees, transparency has become essential for conversion. Moreover, the report reveals that 58% of online shoppers prioritize trusted brands, while 68% identified secure payment options as the top factor in building retailer trust.

The Big Picture

The transformation of payment experiences reflects broader economic and technological shifts reshaping retail. As younger consumers embrace flexible payment solutions and digital wallets, retailers must adapt their strategies to remain competitive. The data suggests successful businesses will need to offer diverse payment options, enhance security measures, and build transparent relationships with customers across multiple channels.

"Even though online shopping is now in its 30s, trust issues are still impacting conversion rates," notes Grant Arnott, CEO of Power Retail. "Online stores have to work harder than their offline counterparts at building trust and confidence, and ensuring secure, reputable payment providers feature prominently is a must."

"The circa 50% usage of Flexible Payment Options by the 18-44 year-old age group means the availability of these payment methods becomes vital in industries targeting this demographic and where spend is discretionary," adds Martinus, highlighting the strategic importance of adapting to changing consumer preferences.

"At Zip, we care deeply about customer experience and payments innovation," says Nitin Kashid, Chief Commercial Officer at Zip. "This next frontier of growth will be captured by merchants beyond traditional retail, such as travel, healthcare, home renovations and education, that are meeting the demand for greater payment flexibility."

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

More on Mencari

5 - Minute recap - for nighly bite-sized news around Australia and the world.

Podwires Daily - for providing news about audio trends and podcasts.

There’s a Glitch - updated tech news and scam and fraud trends

The Expert Interview - features expert interviews on current political and social issues in Australia and worldwide.

Viewpoint 360 - An analysis view based on evidence, produced in collaboration with 360Info

Mencari Banking - Get the latest banking news and financials across Australia and New Zealand

The Mencari readers receive journalism free of financial and political influence.

We set our own news agenda, which is always based on facts rather than billionaire ownership or political pressure.

Despite the financial challenges that our industry faces, we have decided to keep our reporting open to the public because we believe that everyone has the right to know the truth about the events that shape their world.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support Mencari.

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!